We Help Victims of Sexual Harassment

Recent high-profile sex harassment scandals (Roger Ailes, Harvey Weinstein, Bill Cosby, Bill O’Reilly, etc.) highlight the unacceptable fact that sexual harassment in the workplace remains all too prevalent. According to a recent EEOC report, approximately 40% of women have experienced one or more specific sexually-based behaviors in the workplace, such as unwanted sexual attention or sexual coercion.

In the service industry, 66 percent of women reported having been harassed by managers and 30 percent of the women said inappropriate touching was a “common occurrence.”

We are committed to aggressively representing victims of sexual harassment to get them the damages to which they are entitled and hold the perpetrators accountable. Call us today at 202-262-8959 to schedule a confidential consultation.

Remedies for Sexual Harassment

Victims of sex harassment can recover a broad array of damages, including emotional distress damages and punitive damages.

Click here to see a list of some of the largest sexual harassment verdicts and settlements.

Client Reviews of Sex Harassment Lawyer Jason Zuckerman

We are proud of our commitment to exceptional client service, including our prompt response to client inquiries and zealous advocacy. Recently Avvo awarded Jason Zuckerman its Client Choice Award based on client reviews. The following two reviews were provided by former clients of Jason Zuckerman concerning sexual harassment matters:

“I truly can’t say enough good things about Jason and his team – they are incredibly effective, professional, and consistently wonderful to work with, even in very high-pressure circumstances. Jason and his colleagues were exceptionally patient with and responsive to my concerns, consulting with me on every step of the process and explaining different options. Beyond their impeccable legal representation and client advocacy, I also felt personally cared for and supported during what was a particularly nightmarish experience of workplace harassment. When needed, they also devoted significant extra time and effort to my case to ensure that my interests were protected. I am incredibly grateful for their representation and wholeheartedly recommend Zuckerman Law to anyone seeking justice in employment-related matters.”

“When I sought out a DC-based attorney to represent me, I expected a competent attorney who would get me through my sexual harassment lawsuit. What I didn’t expect was to find someone like Jason: a truly outstanding attorney who made me feel like a priority, paid close attention to detail, and brought enormous expertise to the table. I chose to hire Jason to represent me after consulting seven other lawyers — and from day one, Jason was the only one who it clear that he actually cared about me and my case. I cannot be happier that I chose Jason. He represented me with professionalism and fearlessness every step of the way. Jason always made me feel like a priority, even though he was busy with other cases/clients simultaneously. He never rushed me or pressured me, and kept me “in the loop” the entire time while we were dealing with the opposing side.”

Know Your Rights: Download Our Free Guide for Virginia Victims of Sex Harassment

Get Top-Notch Legal Representation for Your Harassment Case

Hiring a proven and effective advocate is critical to obtaining the maximum recovery in a sexual harassment case.

U.S. News and Best Lawyers® have named Zuckerman Law a Tier 1 firm in Litigation – Labor and Employment in the Washington DC metropolitan area. Contact us today to find out how we can help you.

To schedule a free confidential consultation, click here or call us at 202-262-8959.

Tips for Sexual Harassment Victims

- Can an employer be held liable for customer sexual harassment?

- What damages or remedies are available for victims of sexual harassment?

- What is a hostile work environment?

- Can a single incident of harassment suffice to establish liability?

- How do I prove my workplace is a hostile work environment?

- What is quid pro quo harassment?

- What is workplace sexual harassment?

- In a sexual harassment case, does it matter if it is a supervisor versus a co-worker who is harassing me?

- Who is a “supervisor” in sexual harassment cases?

- How can employees combat harassment at work?

- What is the deadline for filing a sex harassment or retaliation claim?

- What type of retaliation is prohibited against an employee who reports unlawful discrimination or harassment?

- Is an employer prohibited from retaliating against an employee because the employee reported harassment?

- What is an employer’s affirmative defense in a sex harassment case?

Top-Rated SEC Whistleblower Law Firm Representing Whistleblowers Nationwide

Leading SEC whistleblower law firm Zuckerman Law is privileged to represent whistleblowers in claims brought under whistleblower reward and whistleblower protection laws. Though our clients work in a wide variety of industries and locations, they typically have one thing in common — they choose not to look the other way when they see wrongdoing and instead speak up.

Our clients deserve an experienced and zealous whistleblower advocate to help them effectively navigate the maze of whistleblower laws and fight hard to obtain the maximum recovery.

To schedule a free, confidential preliminary consultation with our whistleblower attorneys, click here or call us at 202-262-8959.

Whistleblower rewards and whistleblower protection laws are complex and while they can offer substantial rewards, there are many pitfalls that must be considered when devising an effective strategy in a whistleblower case.

We have secured awards for seven whistleblowers, and the courageous whistleblowers that we represent have helped stop more than $1 billion in Ponzi schemes and other fraudulent investment schemes.

In matters in which we obtained SEC whistleblower awards for our clients, the public orders announcing the awards note the “significant assistance” provided to SEC staff that enabled the SEC to complete SEC investigations more quickly.

Recently the Association of Certified Fraud Examiners published a profile of Matt Stock’s success working with whistleblowers to fight fraud:

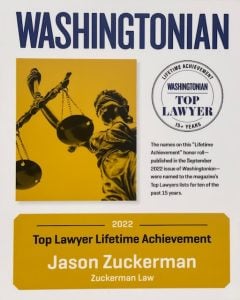

In 2022, whistleblower lawyer Jason Zuckerman was named to Washingtonian Magazine’s “Top Lawyers Hall of Fame.”

Award-Winning Whistleblower Attorneys

U.S. News and Best Lawyers® have named Zuckerman Law a Tier 1 firm in Litigation – Labor and Employment in the Washington DC metropolitan area. In addition, Firm Principal Jason Zuckerman has been:

- recognized by Washingtonian magazine as a “Top Whistleblower Lawyer” in 2022, 2021, 2020, 2019, 2018, 2017, 2015, 2009, and 2007;

- rated AV Preeminent® by Martindale-Hubbell based on peer reviews;

- selected by peers to be included in The Best Lawyers in America® in the category of employment law (2011-2024);

- rated 10 out of 10 by Avvo, based largely on client reviews; and

- selected by peers to be listed in SuperLawyers (2012 and 2015-2024) in the category of labor and employment law.

Top-Rated SEC Whistleblower Attorneys

An experienced SEC whistleblower attorney can maximize the likelihood of recovering an SEC whistleblower award. Under the SEC Whistleblower Program, the SEC is authorized to pay awards for original information about any violation of the federal securities laws, including:

- Accounting fraud;

- Investment and securities fraud;

- Insider trading;

- Foreign bribery and other FCPA violations;

- EB-5 investment fraud;

- Manipulation of a security’s price or volume;

- Fraudulent securities offerings and Ponzi schemes;

- Hedge fund fraud;

- Unregistered securities offerings;

- Investment adviser fraud;

- Broker-dealer anti-money laundering program violations;

- False or misleading statements about a company or investment;

- Inadequate internal controls;

- Deceptive non-GAAP financial measures; and

- Violations of auditor independence rules.

See our column in Forbes: One Billion Reasons Why The SEC Whistleblower-Reward Program Is Effective.

To learn more about incentives for whistleblower to disclose fraud to the SEC, download our free guide SEC Whistleblower Program: Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower Award.

In our guide to the SEC whistleblower program, the whistleblower lawyers at Zuckerman Law share their experience gained from representing whistleblowers before the SEC.

Feedback from Whistleblower Clients

WHEN REVIEWING INFORMATION ABOUT TESTIMONIALS OR STATEMENTS REGARDING A LAWYER’S QUALITY, CONSIDER THAT 1) THE FACTS AND CIRCUMSTANCES OF YOUR CASE MAY DIFFER FROM THE MATTERS IN WHICH RESULTS AND TESTIMONIALS HAVE BEEN PROVIDED; 2) ALL RESULTS OF CASES HANDLED BY JASON ZUCKERMAN ARE NOT PROVIDED AND NOT ALL CLIENTS HAVE GIVEN TESTIMONIALS; AND 3) THE TESTIMONIALS PROVIDED ARE NOT NECESSARILY REPRESENTATIVE OF RESULTS OBTAINED BY JASON ZUCKERMAN OR OF THE EXPERIENCE OF ALL CLIENTS OR OTHERS WITH JASON ZUCKERMAN. EVERY CASE IS DIFFERENT, AND EACH CLIENT’S CASE MUST BE EVALUATED AND HANDLED ON ITS OWN MERITS.

- Jason Zuckerman is the most focused, thoughtful and aggressive attorneys I have ever known, let alone had the pleasure to have on my side in a highly complex legal case. He brought well-honed legal insights and a rapid pace to our legal preparations. He forcefully brought those preparations to the opposing side, which gave them little choice but to engage with us until a positive settlement was reached. In addition, we found Jason to be extremely responsive at every step, even if it required working past midnight. His character is beyond reproach and his dedication through the entire process was unwavering. If I ever need someone in my legal court again, I won’t hesitate for even a second, before I seek Jason’s support.

- Jason is everything you could possibly ask for an an attorney: highly intelligent, thoughtful, and extraordinarily knowledgeable in his specialty of the law. In a very short period of time Jason was able to assimilate a laundry list of details and offer a compelling strategy on how to effectively proceed. Moreover, he is extremely responsive.

- Jason is the consummate professional when it comes to SOX retaliation claims. He is, without question, one of the most deeply knowledgeable, technical, and astute attorneys in this very specialized body of law. During one of the most difficult times in my professional career, Jason not only provided exceptional legal guidance, but equally as important, he provided emotional support that was vital to my family and me. Jason ran circles around the “major national law firm” team that was assigned to defend my employer. In fact, Jason made them look silly at times. Jason always advocated my best interests, not his own. Jason is not only an exceptional attorney who helped my family to achieve a favorable outcome, but he is a friend. I’ve worked with major law firms throughout my career and when it comes to SOX and employment law matters, there is not a finer, more talented attorney than Jason Zuckerman.

- Jason did an exceptional job in quickly understanding the intricacies of my case, grasping not only his field of expertise of employment law, but also the violations of law and SEC Regulations that were central to my dispute. The overall strategy he utilized insured that opposing counsel was challenged and made clear that this case would simply not proceed based on a timetable convenient to them. Jason is thorough, accurate and seemingly working at all hours based on phone calls and correspondence. Fortunately Jason has a very down to earth personality, understands issues readily and can convey in understandable language current “legal” circumstances and probable outcomes. I would easily and thoroughly recommend Jason for issues related to a Sarbanes-Oxley or employment related dispute.

- I selected Jason to handle my case after consulting with three other lawyers because of his extensive SOX experience and negotiation skills. My decision paid off as he easily surpassed all of my expectations. He quickly analyzed the merits of my case and aggressively engaged my former employer to reach a favorable settlement, avoiding years of potential litigation. He was responsive, professional, ethical and a great advocate on my behalf. I truly believe that I could not have found a better lawyer to represent my interests. He would be the first person I would recommend if a colleague or friend were to ever need similar services. Put simply, Jason is a top notch lawyer who works tirelessly to achieve a positive outcome for his clients. It’s easy to see why he is regarded as an expert in the field.

- Thank the Lord I found Jason Zuckerman. I was in a bad situation; I was put on leave from my company after reporting to the Board of Directors that the CEO asked me to make some questionable accounting entries (I was the CFO). The company took the CEO’s side and I was left out in the cold by trying to do the right thing. I was left hanging on leave and being interviewed by a company hired investigator. I found Jason and he immediately put me at ease and took over. All of a sudden the company was on the defensive and I was on the offensive. It was over in two weeks.

- I hired Mr Zuckerman to pursue an action against a former employer that was attempting to use deceit in its pursuit of federal contracts, and which fired me for not participating in its schemes. Jason was not just very responsive, he was also engaging, spending a good deal of time and effort with me on the phone and by email learning the ins and outs of the case, discussing strategy, laying out alternatives, anticipating counter-arguments, etc, all with the highest integrity. In the end, Jason was able to negotiate a substantial settlement for me, and I believe the company learned not to fire employees for failing to participate in lying to the government. All in all, a very good outcome.I have had the opportunity in my career to interact with numerous attorneys. Jason truly stands out. I wholeheartedly recommend him to anyone seeking a lawyer for wrongful termination and related employment issues.

Tips for Whistleblowers to Qualify for an SEC Whistleblower Award

SEC Whistleblower Awards Lawyers

SOX Whistleblower Protection Lawyers

Effective and Experienced Maryland Employment Lawyer

When our clients face discrimination or retaliation in the workplace, a lot is on the line – their career, reputation, and financial security. We fight hard to get our clients the compensation they deserve. To schedule a confidential consultation, call us today at 202-262-8959, or click here.

Bethesda-Chevy Chase Employment Discrimination Lawyers

We handle a wide range of employment matters for employees in Maryland, including:

- Glass ceiling discrimination;

- Sexual harassment;

- Race discrimination;

- Gender discrimination, including Equal Pay Act claims;

- LGBT discrimination;

- Religious discrimination;

- Disability discrimination;

- Pregnancy discrimination; and

- Age discrimination

We are located in Chevy Chase, Maryland at 5425 Wisconsin Avenue Suite 600 Chevy Chase, MD 20815.

Bethesda-Chevy Chase Employment Lawyer

Hiring a proven and effective advocate is critical to obtaining the maximum recovery. U.S. News and Best Lawyers® have named Zuckerman Law a Tier 1 firm in Litigation – Labor and Employment in the Washington DC metropolitan area. Contact us today to find out how we can help you.

Hiring a proven and effective advocate is critical to obtaining the maximum recovery. U.S. News and Best Lawyers® have named Zuckerman Law a Tier 1 firm in Litigation – Labor and Employment in the Washington DC metropolitan area. Contact us today to find out how we can help you.

Summary

We are a Washington, DC-based law firm that represents whistleblowers in whistleblower rewards and whistleblower retaliation matters and litigates discrimination claims on behalf of employees in the District of Columbia, Maryland, and Virginia. The firm is dedicated to zealously advocating on behalf of our clients to achieve justice and accountability.

-

Professionalism

(5)

-

Honesty

(5)

-

Perseverance

(5)

Overall

User Review

( vote)

OFAC sanctions whistleblower lawyers, who are crucial in guiding individuals through legal procedures, ensuring compliance, and securing the maximum legal benefits.

Whistleblower Rewards for Reporting Sanctions Evasion

The Anti-Money Laundering Whistleblower Improvement Act of 2022 amended the Anti-Money Laundering Act (AMLA) to require the Department of the Treasury to pay awards to whistleblowers for voluntary disclosures of original information that results in the collection of penalties above $1 million for a violation of U.S. sanctions.

A whistleblower who reports original information about sanctions evasion can obtain an award of 10% to 30% of the collected monetary sanctions. Sanctions evasion whistleblowers can report anonymously if represented by an attorney. The AMLA also provides a remedy for whistleblowers that suffer whistleblower retaliation.

Call us today to find out more about whistleblower incentives and protections and how we can help you report sanctions evasion and qualify for a whistleblower award. You can contact us by phone or via WhatsApp or Signal at 202-930-5901 or 202-262-8959.

See our guide to the OFAC Whistleblower Reward Program: Strengthened Enforcement of Sanctions Evasion Enhances Incentives for Sanctions Whistleblowers and the Whistleblower Lawyer’s Guide to the Anti-Money Laundering Whistleblower Program.

Guidance on OFAC’s Enforcement and Compliance Policies

- OFAC Enforcement Guidelines

- Memoranda of Understanding Between OFAC and Bank Regulators

- Guidance on Submitting Electronic Documents to OFAC Enforcement

OFAC Sanctions Evasion Whistleblower Reward Program

Reporting a Violation of U.S. Economic Sanctions Can Qualify for a Whistleblower Award Under AMLA or SEC Whistleblower Reward Programs

Violating U.S. economic sanctions can implicate violations of disclosure duties under federal securities laws and therefore whistleblowing about sanctions evasion can potentially qualify for an SEC whistleblower award.

Violating U.S. economic sanctions can implicate violations of disclosure duties under federal securities laws and therefore whistleblowing about sanctions evasion can potentially qualify for an SEC whistleblower award.OFAC Sanctions Evasion Whistleblower Rewards Law Firm

The sanctions evasion whistleblower lawyers at Zuckerman Law have experience representing sanctions evasion whistleblowers and one of our attorneys is also a Certified Public Accountant and Certified Fraud Examiner.

Experienced and effective sanctions evasion whistleblower attorneys can provide critical guidance and effective advocacy to whistleblowers to increase the likelihood that they get the maximum award from the FinCEN Whistleblower Program.

U.S. News and Best Lawyers® have named Zuckerman Law a Tier 1 firm in Litigation – Labor and Employment in the Washington DC metropolitan area.

For more information about sanctions evasion whistleblower rewards and bounties, contact the whistleblower lawyers at Zuckerman Law at 202-262-8959.

Click here to read reviews and testimonials from former clients.

How is the OFAC application process?

A CRS report titled Enforcement of Economic Sanctions: An Overview provides the following summary of OFAC’s enforcement process:

“If OFAC suspects that a person or entity may be acting in violation of economic sanctions, it may open enforcement proceedings. Based on the evidence, OFAC may issue a finding of no violation, a request for further information, a cautionary letter, a finding of a violation, a finding of a violation with civil monetary penalty, or a criminal referral. Should OFAC have reason to believe that the sanctions violation may be ongoing or recur, it may also issue a cease-and-desist order. Where relevant, OFAC may also revoke, suspend, modify, withhold, or deny licenses to engage in certain transactions.

If OFAC imposes a monetary penalty, the amount varies depending on the relevant statutory authority and an

evaluation of the circumstances. To calculate the penalty, OFAC first determines the “base amount” by considering whether the violation qualifies as “egregious” and whether the individual voluntarily self-disclosed the violation. The egregiousness determination is based on a consideration of factors including the violator’s willfulness, harm to the sanctions program’s objectives, and individual characteristics (e.g., commercial sophistication). Then OFAC considers aggravating and mitigating factors, including whether the violator took remedial action or cooperated with OFAC’s investigation to calculate a final penalty. Should OFAC believe that a particular case might warrant criminal penalties, it may refer the case to DOJ. Violators face civil penalties of up to $250,000 (which, as annually adjusted under the Federal Civil Penalties Inflation Adjustment Act of 1990, now amounts to $368,136) or “an amount that is twice the amount of the transaction that is the basis of the violation.” See Economic Sanctions Enforcement Guidelines. Seventy-five percent of the civil penalties and net proceeds of forfeitures related to violation of sanctions and other criminal provisions involving designated state sponsors of terrorism go into the United States Victims of State Sponsored Terrorism (USVSST) Fund. Otherwise, civil fines are deposited into the General Fund of the U.S. Treasury. Proceeds of the remaining 25% and most other civil forfeitures for sanctions violations are deposited into the DOJ Asset Forfeiture Fund or the

Treasury Forfeiture Fund.”

OFAC Enforcement and Compliance Policies

- A Framework for OFAC Compliance Commitments

- OFAC Enforcement Guidelines

- Memoranda of Understanding Between OFAC and Bank Regulators

- Memorandum of Understanding Between OFAC and the State of Delaware Department of Justice

- OFAC Office of Compliance and Enforcement Data Delivery Standards Guidance: Preferred Practices for Productions to OFAC

- Advisory and Guidance on Potential Sanctions Risks Arising from Dealings in High-Value Artwork

- Sanctions Compliance Guidance for the Virtual Currency Industry

- Sanctions Compliance Guidance for Instant Payment Systems

- Tri-Seal Compliance Note: Voluntary Self-Disclosure of Potential Violations

- Quint-Seal Compliance Note: Know Your Cargo: Reinforcing Best Practices to Ensure the Safe and Compliant Transport of Goods in Maritime and Other Forms of Transportation

- Tri-Seal Compliance Note: Obligations of foreign-based persons to comply with U.S. sanctions and export control laws