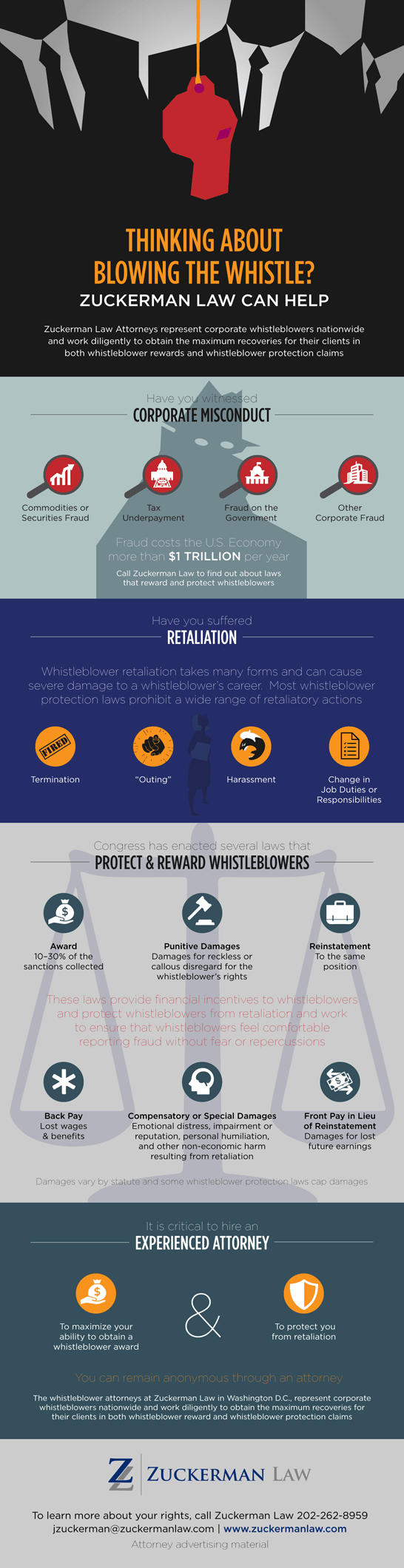

Top-Rated Foreign Bribery and FCPA Whistleblower Attorneys

Under the Dodd-Frank Act’s SEC Whistleblower Program, whistleblowers may receive a reward for reporting a violation of the U.S. Foreign Corrupt Practices Act (“FCPA”) to the SEC. As detailed in the SEC’s Resource Guide, the FCPA prohibits the payment of bribes to foreign officials to assist in obtaining or retaining business. This anti-bribery provision broadly applies to:

- U.S. persons;

- U.S. and foreign public companies that are listed on the stock exchanges in the United States or that are required to file periodic reports with the SEC; and

- certain foreign persons and companies that are acting while in U.S. territory.

The FCPA also requires issuers to maintain adequate internal controls. These controls must provide reasonable assurance that transactions are executed and that assets are accessed and accounted for in accordance with management’s authorization. By maintaining these controls, companies are able to provide more-accurate books and records. Common violations of the FCPA internal-controls provision include:

- falsifying documents to conceal bribery payments;

- fraudulently mischaracterizing bribes as normal business expenses;

- overbilling with an understanding that some of the payment is a bribe; and

- inappropriate hiring practices, such as hiring candidates solely based on referrals by client executives and government officials.

There is no “materiality” consideration under the books-and-records provision of the FCPA—any failure is considered a statutory violation.

SEC Whistleblower Program and FCPA Whistleblower Awards

Since 2011, the SEC Whistleblower Office has issued more than $1 billion in awards to whistleblowers. The largest SEC whistleblower awards are $114 million and $110 million. In 2019, the total penalties for FCPA violations exceeded $2.5 billion. Whistleblowers disclosing FCPA violations can be eligible for significant awards.

We have represented whistleblowers disclosing bribery and FCPA violations worldwide, including in China, Angola, Central America, the Middle East, and Europe, and have obtained recoveries for whistleblowers disclosing bribery.

If you have information that may qualify for an SEC whistleblower award, contact the Director of our SEC whistleblower practice at [email protected] or call our leading SEC whistleblower lawyers at (202) 930-5901 or (202) 262-8959. All inquiries are confidential.

In conjunction with our courageous clients, we have helped the SEC halt multi-million dollar investment schemes, expose violations at large publicly traded companies and return funds to defrauded investors. Read our tips for SEC whistleblowers and Forbes column about the success of the SEC whistleblower program.

For more information about the SEC Whistleblower Program, see our eBook Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower Award. Click below to hear SEC whistleblower lawyer Matt Stock’s tips for SEC whistleblowers:

SEC Whistleblower Awards for Disclosures of Foreign Bribery and FCPA Violations

For example, on December 15, 2008, Siemens AG agreed to pay $350 million in disgorgement to settle the SEC’s charges of violating the FCPA, as well as a $450 million fine to the DOJ to settle criminal charges, totaling $800 million in monetary sanctions. If these two actions occurred today and were based on original information voluntarily provided to the SEC by an eligible whistleblower, the SEC would be required to pay an award to that whistleblower of between $80 million (10% award) and $240 million (30% award) for the two actions. See additional examples of FCPA enforcement actions below.

To learn more about the FCPA, see the DOJ’s FCPA Fact Sheet and FCPA Resources Guide.

Top Enforcement Actions for FCPA/Foreign Bribery Violations

The table below identifies some of the top SEC and DOJ enforcement actions against companies for FCPA violations:

| Company | Monetary Sanctions | FCPA Violation |

|---|---|---|

| Odebrecht | $3.5 Billion | Brazil-based global construction company Odebrecht had a complex corruption scheme that paid out hundreds of millions of dollars in bribes to government officials on three continents for more than a decade. Odebrecht’s sophisticated bribery operation included the creation of a secret financial structure within the company called “Division of Structured Operations.” Its sole purpose was accounting for and disbursing bribery payments. A separate, off-book communications system was used to facilitate and record the illegal payments. Funds were passed through several shell companies to further conceal the bribery. |

| Petrobas | $1.78 Billion | Senior Petrobras executives inflated the cost of infrastructure projects by overpaying contractors that in turn, paid billions in kickbacks to Petrobras executives, who then shared the proceeds with Brazilian politicians and political parties. Petrobras fraudulently recorded the bribes as funds spent on improving and procuring assets, resulting in an overstatement of assets totaling approximately $2.5 billion. |

| Ericsson | $1 Billion | According to the DOJ's announcement of the settlement: "...beginning in 2000 and continuing until 2016, [Ericsson] conspired with others to violate the FCPA by engaging in a longstanding scheme to pay bribes, to falsify books and records and to fail to implement reasonable internal accounting controls. Ericsson used third party agents and consultants to make bribe payments to government officials and/or to manage off-the-books slush funds. These agents were often engaged through sham contracts and paid pursuant to false invoices, and the payments to them were improperly accounted for in Ericsson’s books and records." |

| Telia Company AB | $965 Million | Swedish telecommunications company Telia Company AB and its Uzbek subsidiary Coscom LLC, paid $331 million in bribes to a high ranking Uzbek government official so that Telia could enter the Uzbek telecommunications market and Coscom could gain valuable telecom assets in Uzbekistan. The bribes were concealed through multiple payments, including to a shell company owned by the government official. |

| Braskem S.A. | $957 Million | Brazilian-based petrochemical manufacturer Braskem violated the FCPA by concealing bribes paid to government officials in Brazil through intermediaries over an 8 year period. Braskem paid approximately $250 million into Odebrecht’s (see above) secret bribe payment system and then authorized payments to various politicians, political parties, and officials in Brazil to receive preferential treatment, contracts, and favorable legislation related to the state-controlled oil company Petrobas. |

| Siemens AG | $800 Million | German company Siemens made illicit payments to foreign government officials in numerous countries in exchange for favorable business treatment during bidding processes. It also “engaged in systematic efforts to falsify its corporate books and records and knowingly failed to implement and circumvent existing internal controls.” Bribery by Siemens AG included: in Iraq, four Siemens subsidiaries paid Iraqi government officials $1.7 billion to win 42 contracts as part of the UN Oil-For-Food Program; in Bangladesh, over $5 million in payments were made to officials during a mobile telephone project; in Argentina, over $31 million in payments were made to officials during a national ID card project; in Venezuela, over $18 million in payments were made during two mass transit projects. |

| VimpelCom and Unitel, LLC | $795 Million | The world’s sixth largest telecommunications company VimpelCom and its Uzbek subsidiary Unitel LLC violated the FCPA when they engaged in a conspiracy to make over $114 million in bribery payments to a government official in Uzbekistan over a six year period in exchange for their entrance and continued operations in the Uzbek telecommunications market. The payments were laundered through bank accounts around the world and falsely recorded in company records as equity transactions, consulting and repudiation agreements, and reseller transactions. The bribes were made to the same government official that received illegal payments from Telia company (see above). |

| Alstom | $772 Million | French power and transportation company Alstom S.A. violated the FCPA both by “falsifying its books and records and failing to implement adequate internal controls” and “conspiracy to violate the anti-bribery provisions.” Alstom paid bribes to government officials in many countries around the world, including Egypt, Indonesia, Saudi Arabia, Taiwan, and the Bahamas in exchange for contracts in several power, grid, and transportation projects. |

| KBR-Halliburton | $579 Million | Kellogg Brown & Root LLC (KBR) violated the FCPA by bribing senior government officials in Nigeria over a 10 year period to obtain engineering, procurement, and construction (EPC) contracts. Former parent company Halliburton did not prevent or detect the bribery and falsified records to hide the bribery payments. KBR was part of a four company joint-venture partnership in which all four companies participated in illegal payments to government officials in exchange for Nigerian EPC contracts valued at over $6 billion. |

| Teva Pharma | $519 Million | Teva Pharmaceutical Industries Ltd. (Teva) violated the FCPA by bribing government officials in Russia, Ukraine, and Mexico. In Russia, bribes were paid to influence the increase in sales of Teva’s multiple sclerosis drug Copaxone by the Russian Ministry of Health. In the Ukraine, bribes were paid to influence the government’s approval of Teva drug registrations. In Mexico, bribes were paid to doctors employed by the Mexican government to prescribe Copaxone to patients. |

| Och-Ziff Capital Management Group, LLC | $412 Million | Och-Ziff, a New York-based investment and hedge fund manager, violated the FCPA by repeatedly facilitating corrupt transactions that they knew were bribes being paid to government officials in the Democratic Republic of the Congo, Libya, Chad, and Niger to secure investment opportunities. Och-Ziff was charged with two counts of conspiracy to violate the anti-bribery provisions of the FCPA, one count of fasifying records, and one count of inadequate internal controls. |

| BAE | $400 Million | BAE Systems PLC (BAES) violated the FCPA when it “knowingly and willfully failed to create sufficient compliance mechanisms to prevent and detect violations of the anti-bribery provisions of the FCPA” after stating it would create and implement such policies to ensure FCPA compliance to various U.S. government agencies. BAES regularly hired “marketing advisors” to assist in securing sales of defense items and concealed those relationships from the U.S. government. It made payments to these marketing advisors via shell companies that were not subjected to the level of scrutiny that BAES had told the U.S. government, leading to a violation of making false statements about its FCPA compliance program. |

| Total SA | $398 Million | French oil and gas company Total violated the FCPA when it made approximately $60 million in bribe payments over a nine year period to an Iranian government official in exchange for lucrative oil rights in the Sirri A and E and South Pars oil and gas fields. The illegal payments were cited as business development expenses and made to intermediaries hired as consultants, as designated by the Iranian government official. |

| Alcoa | $384 Million | Alcoa’s Australian subsidiary repeatedly paid bribes to government officials in Bahrain via a London-based consultant hired to assist in negotiations for long-term alumina supply agreements with Alba, one of the largest aluminum smelters in the world and controlled by Bahrain’s government. Alcoa’s mining operations in Australia were the source of the alumina supplied to Alba. The consultant generated the funds needed to pay bribes from commissions and price markups. Bribes were paid to Bahraini government officials, members of Alba’s board of directors, and Alba senior management. Alcoa was found to have failed to implement sufficient internal controls to prevent and detect such bribes. |

| ENI S.p.A, Snamprogetti | $365 Million | Snamprogetti and ENI violated the FCPA’s anti-bribery provisions when they engaged in a decade-long bribery scheme with companies KBR, Technip, and JGC of Japan to bribe Nigerian officials in exchange for EPC contracts by Nigeria LNG Ltd. The four company joint venture was called TSKJ and won contracts to build liquefied natural gas (LNG) facilities on Bonny Island worth more than $6 billion. TSKJ hired two agents to pay the bribes to Nigerian government officials through various sources on behalf of their joint-venture. |

| Technip | $338 Million | Paris-based Technip, a global engineering, construction and services company participated in a decade-long bribery scheme to obtain engineering, procurement, and construction (EPC) contracts in Nigeria with their joint venture partners KBR, Snamprogetti, and JGC of Japan. The contracts to build LNG facilities on Bonny Island were valued at more than $6 billion. |

FCPA/Foreign Bribery SEC Whistleblower Lawyers

Qualifying for an FCPA SEC Whistleblower Award

Recent SEC and DOJ Anti-Bribery FCPA Enforcement Actions

The SEC and DOJ, which are the agencies charged with enforcing the FCPA, have aggressively pursued foreign bribery cases. Since the enactment of the FCPA, the agencies have prioritized the Act and have imposed substantial fines on companies for violations. Examples include:

- On January 9, 2014, ALCOA paid $175 million in disgorgement to the SEC and $223 million in criminal fines and forfeiture to the DOJ for bribing government officials in Bahrain.

- On September 29, 2016, Och-Ziff Capital Management Group LLC agreed to pay nearly $200 million in disgorgement to the SEC and a criminal penalty of more than $213 million to the DOJ to settle charges that the hedge fund violated the FCPA by using intermediaries and business partners to pay bribes to government officials in Africa.

- On November 17, 2016, JPMorgan Chase agreed to pay $264 million in sanctions to the SEC, DOJ and Federal Reserve Board of Governors for a client-referral hiring program called the “Sons and Daughters Program.” This program was expressly designed to hire candidates referred by client executives and government officials. By employing these referrals, the bank was able to win business that generated millions in revenues. From 2006 to 2013, JPMorgan did not deny a single referral from the program. This enforcement action represents the third time the SEC has fined a company for hiring officials’ relatives in violation of FCPA. Andrew Ceresney, SEC Enforcement Division Chief, has indicated that the SEC will continue to sweep the referral hiring practices.

- On December 21, 2016, engineering conglomerate Odebrecht and Braskem agreed to pay a total of $3.5 billion in a record FCPA settlement with U.S., Brazilian, and Swiss authorities. Beginning in 2001, the companies used a hidden business unit to pay hundreds of millions of dollars in bribes to corrupt foreign officials in the Petrobras corruption scandal. Investors brought a class action suit against the Brazilian oil giant Petrobras as a result of the scandal, which settled for $3 billion.

- On December 22, 2016, Teva Pharmaceutical Industries Ltd. agreed to pay $519 million to the SEC and DOJ to settle U.S. charges that it violated the FCPA by paying bribes in its operations in Ukraine, Mexico, and Russia. The U.S. has extensively enforced the FCPA on pharmaceutical firms over the years, especially in countries with national health systems. In these countries, doctors are considered “public officials” for FCPA purposes, which dramatically increases their exposure to FPCA violations. Also in 2016, pharmaceutical giants GlaxoSmithKline, AstraZeneca, and Novartis all settled cases involving FCPA violations.

- On January 16, 2017, Rolls-Royce agreed to pay $809 million to the DOJ to settle allegations of a long-running scheme to bribe government officials in exchange for government contracts. The settlement proceeds were split between the UK, the United States, and Brazil. The Department of Justice reported that it received nearly $170 million. Read more here.

- On January 18, 2017, medical device company Orthofix International agreed to pay more than $14 million to the SEC to settle charges that it made improper payments to doctors at government-owned hospitals in Brazil in order to increase sales and improperly booked revenue causing the company to materially misstate financial statements from at least 2011 to Q1 2013.

- On July 27, 2017, oil field service company Halliburton agreed to pay $29.2 million to the SEC to settle charges that it violated the books and records and internal accounting controls provisions of the FCPA by failing to conduct competitive bidding and awarding lucrative oilfield services contracts to a specific local company owned by a former Halliburton employee who was a friend and neighbor of the government official who would ultimately approve the award of the contracts. Halliburton outsourced more than $13 million worth of business to the local company.

- On September 21, 2017, telecommunications provider Telia Company AB agreed to pay $965 million to settle charges that it offered and paid at least $330 million in bribes to enter the Uzbek telecommunications market. According to the SEC’s order, Telia paid the bribes through a shell company that was controlled by an Uzbek government official who was in a position to exert significant influence over other Uzbek officials, causing them to take official actions to benefit Telia’s business in Uzbekistan.

- On November 29, 2017, SMB Offshore, a company specializing in manufacture and design of offshore oil drilling equipment, agreed to pay $238 million to resolve charges that the company bribed foreign officials in Brazil, Angola, Equatorial Guinea, Kazakhstan and Iraq for government contracts. According to the DOJ, the company paid more than $180 million to middlemen while knowing that the money would go towards bribing officials. The scheme involved some of the highest-level executives within the company and lasted for more than a decade (1996-2012). The company entered into a deferred prosecution agreement.

- On December 22, 2017, Keppel Offshore & Marine Ltd. (KOM) and its U.S. subsidiary agreed to pay approximately $422 million to resolve charges that it violated the FCPA by paying millions to public officials in Brazil to win contracts with the Brazilian state-owned oil company Petrobras. According to the information filed in the Eastern District of New York, the bribery scheme yielded $350 million in profits. KOM used agreements with consulting companies to facilitate the bribe payments to obtain business from Petrobras and conceal the bribes. KOM is paying approximately to U.S. regulators and the remaining amount to enforcement authorities in Singapore and Brazil.

- On April 30, 2018, Panasonic agreed to pay $143 million to resolve charges of FPCA and accounting fraud violations involving its global avionics business. According to the SEC’s order, Panasonic offered a lucrative consulting position to a government official at a state-owned airline to induce the official to help Panasonic in obtaining and retaining $700 million in business from the airline. In addition, the SEC found that Panasonic fraudulently overstated net income by more than $82 million for the fiscal year ending June 30, 2012, by prematurely recognizing revenue on an agreement. Panasonic accomplished the fraud by backdating the agreement and providing misleading information to its external auditor.

- On July 5, 2018, the SEC announced that Credit Suisse Group AG agreed to pay $30 million to the SEC and $47 million to the DOJ to resolve charges that it violated the anti-bribery and internal accounting provisions of the FCPA. According to the SEC’s order, between at least 2007 and 2013, Credit Suisse provided valuable employment to the relatives and friends of certain foreign government officials as a personal benefit to the requesting officials in order to obtain or retain investment banking business or other benefits for the bank. This quid pro quo arrangement resulted in multiple deals and substantial profits for Credit Suisse. Specifically, the SEC found that in a six-year period, Credit Suisse offered to hire more than 100 individuals referred by or connected to foreign government officials, resulting in millions of dollars of business revenue.

- On August 27, 2018, Legg Mason Inc. paid approximately $34 million to resolve an SEC charge that a subsidiary Permal Group Inc. partnered with Société Générale S.A., to solicit business from state-owned financial institutions in Libya by paying bribes through an intermediary. Société Générale paid the Libyan Intermediary approximately $26.25 million for supposed “introductory” services and Lybian financial institutions purchased seven structured notes linked to funds managed by Permal that were worth approximately $950 million. Legg Mason agreed to disgorge approximately $27.6 million of ill-gotten gains and pay $6.9 million in prejudgment interest.

- On September 4, 2018, the SEC announced that Paris-based pharmaceutical company, Sanofi, agreed to pay more than $25 million to resolve charges that its subsidiaries made corrupt payments to win business. According to the SEC’s order, the schemes involved bribing government officials and healthcare providers in order to be awarded tenders and to increase prescriptions of its products. The SEC’s press release indicated that the Commission will continue to focus on bribery in connection with pharmaceutical sales as it remains a significant problem.

- On September 12, 2018, United Technologies Corporation (UTC) agreed to pay $13.9 million to resolve charges that it violated the FCPA by paying Azerbaijani officials to facilitate the sales of elevator equipment for public housing in Baku and as part of a kickback scheme to sell elevators in China. The scheme in Azerbaijan involved the use of sham subcontractors and intermediaries to make improper payments. According to the order, the violation in China entailed UTC, through its joint venture, making unsupported payments to a sales agent, “disregarding the high probability that at least some of the money would be used to make unlawful payments to a Chinese official to obtain confidential information to sell engines to a Chinese state-owned airline.” UTC self-reported the misconduct and timely provided facts developed during its internal investigation.

- On December 6, 2019, Ericsson agreed to pay over $1 billion to resolve FCPA violations arising out of the Company’s scheme to make and improperly record tens of millions of dollars in improper payments around the world for approximately 17 years. That amount includes $540 million that will be paid to the SEC for disgorgement and prejudgment interest. According to a Department of Justice press release, Ericsson used third-party agents and consultants to make bribe payments to government officials and/or to manage off-the-books slush funds. These agents were often engaged through sham contracts and paid pursuant to false invoices, and the payments to them were improperly accounted for in Ericsson’s books and records.

- On June 25, 2020, pharmaceutical company Novartis agreed to pay $346 million to settle SEC and DOJ charges that the company violated the FCPA. According to the SEC’s press release announcing the settlement, between 2012 and 2016 “Novartis or its former subsidiary Alcon Inc. engaged in schemes to make improper payments or to provide benefits to public and private healthcare providers in South Korea, Vietnam, and Greece in exchange for prescribing or using Novartis or Alcon products.”

For a detailed list of previous SEC enforcement actions for FCPA violations, click here.

Foreign Bribery and FCPA Violations in Real Estate, Construction and Infrastructure

According to EY’s 2017 Report on Bribery, the “real estate, construction, and associated industries are among the sectors with the highest level of corruption risk.” Indeed, the report reveals that 13% of companies in EY’s 2016 Global Fraud Survey “thought that bribery was ‘common practice’ in the industry.” By 2025, EY predicts that global infrastructure spending will reach $9 trillion, more than doubling the 2012 spending of $4 trillion.

In the report, EY identifies “corruption pressure points” that explain why the risk of corruption is so high in the industry. Two of the pressure points listed are:

- Bribe takers – the ultimate decision-making control is generally assigned to a small group of individuals in the public sector. This provides many opportunities for solicitation by public officials.

- Bribe givers – most projects require additional help (local subcontractors, consultants and agents) who may be willing to pay bribes to secure business or obtain permits.

Finally, the report highlights that two-thirds of the foreign bribery cases in 2014 occurred in only five sectors: extractive (19%), construction (15%), transportation and storage (15%), information and communication (10%), and manufacturing (8%). Due to the rise in enforcement, we expect to see continued focus on these industries.

CFTC Enforcement of the FCPA and CFTC Whistleblower Reward Program

Some FCPA violations also implicate the Commodity Exchange Act, i.e., bribery can give rise to liability for fraud, manipulation, false reporting, or a number of other types of violations under the CEA and CFTC regulations. According to a CFTC whistleblower alert, foreign corrupt practices may include:

- Corrupt practices that alter the prices in commodity markets that drive U.S. derivatives prices;

- Bribes employed to secure business in connection with regulated activities like trading, advising, or dealing in swaps or derivatives, paid out of funds investors believed were being used to invest; or

- Corrupt practices used to manipulate benchmarks that serve as the basis for related derivatives contracts, as prices that are the product of corruption might be falsely reported to benchmarks.

Top-Rated Foreign Bribery and FCPA Whistleblower Attorneys

To learn more about the SEC Whistleblower Program, download Zuckerman Law’s eBook: SEC Whistleblower Program: Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower Award:

U.S. News and Best Lawyers® have named Zuckerman Law a Tier 1 firm in Litigation – Labor and Employment in the Washington DC metropolitan area in the 2018 edition “Best Law Firms.”

Process to Obtain FCPA Whistleblower Bounty

FCPA Whistleblower Bounties

Whistleblower Protection for Whistleblowers Reporting Bribery or FCPA Violations

The SEC Whistleblower Program also protects the confidentiality of whistleblowers and does not disclose information that might directly or indirectly reveal a whistleblower’s identity. Furthermore, the Dodd-Frank Act protects whistleblowers from retaliation by their employers for reporting violations of securities laws to the SEC.

In addition, other federal and state whistleblower protection laws can protect disclosures concerning bribery or violations of the Foreign Corrupt Practice. See our post: Are disclosures or complaints about the books and records provisions of the FCPA protected under SOX?

To learn more about Sarbanes-Oxley whistleblower protection, download our free guide to the Sarbanes-Oxley whistleblower protection law:

Report Insider Trading and Earn an SEC Whistleblower Award

Individuals are liable for insider trading violations when they buy or sell a security in breach of a fiduciary duty or other relationship of trust and confidence, while in possession of material, nonpublic information about the security. Under the SEC Whistleblower Program, individuals may be eligible for an award if they report original information about insider trading to the SEC. Whistleblowers can submit a tip anonymously to the SEC if represented by counsel.

As the SEC has warned, there is a heightened risk of insider trading after the COVID-19 pandemic.

[I]n these dynamic circumstances, corporate insiders are regularly learning new material nonpublic information that may hold an even greater value than under normal circumstances. This may particularly be the case if earnings reports or required SEC disclosure filings are delayed due to COVID-19. Given these unique circumstances, a greater number of people may have access to material nonpublic information than in less challenging times. Those with such access – including, for example, directors, officers, employees, and consultants and other outside professionals – should be mindful of their obligations to keep this information confidential and to comply with the prohibitions on illegal securities trading. Trading in a company’s securities on the basis of inside information may violate the antifraud provisions of the federal securities laws.

SEC Whistleblower Program

Under the SEC Whistleblower Program, whistleblowers may be eligible for monetary awards when they voluntarily provide the SEC with original information about violations of federal securities laws, including insider trading, that leads the SEC a successful enforcement action resulting in monetary sanctions in excess of $1 million. Whistleblowers are eligible to receive between 10% and 30% of the monetary sanctions collected.

Since 2012, the SEC has issued nearly $1 billion in awards to whistleblowers. The largest SEC whistleblower awards to date are:

- $114 million,

- $50 million, and

- $50 million.

If you have information that may qualify for an SEC whistleblower award, contact the Director of our SEC whistleblower practice at [email protected] or call our leading SEC whistleblower lawyers at (202) 930-5901 or (202) 262-8959. All inquiries are confidential. In conjunction with our courageous clients, we have helped the SEC halt multi-million dollar investment schemes, expose violations at large publicly traded companies, and return funds to defrauded investors.

Tips for Qualifying for an SEC Whistleblower Award

Insider Trading

Under federal securities laws, a “relationship of trust and confidence” may exist in many circumstances, as highlighted in SEC Rule 10b5-2. Information is considered “material” if it would be important to a reasonable investor in making an investment decision. For example, insider-trading violations may occur when an individual:

- tips material, nonpublic information;

- trades securities based on tipped information; or

- trades securities based on misappropriated information.

Purpose of Insider Trading Laws

Insider-trading laws are designed to protect market integrity and prevent individuals from profiting unlawfully. Prosecuting insider-trading violations is a top enforcement priority of the SEC and the agency will bring cases against individuals trading on inside information even when their profits are not relatively insignificant to other areas of enforcement.

For example, on March 23, 2017, the SEC announced that it settled charges against Steven A. Hartung who allegedly earned $60,000 on a family member’s inside information about Merck & Co. Inc.’s 2014 acquisition of Idenix Pharmaceuticals. The SEC disgorged his gains and Hartung agreed to pay an equivalent penalty and interest for a total settlement of $123,000. While this settlement amount would not qualify a whistleblower for an award under the SEC Whistleblower Program, it nevertheless underscores that the SEC is targeting any individual who trades on inside information – even if it does not result in a multi-million-dollar profit.

Types of Insider Trading Cases Bought by the SEC

According to the SEC’s Insider Trading webpage, the agency has brought insider-trading cases against:

- corporate officers, directors, and employees who traded the corporation’s securities after learning of significant, confidential corporate developments;

- friends, business associates, family members, and other ‘tippees’ of such officers, directors, and employees, who traded the securities after receiving such information;

- employees of law, banking, brokerage and printing firms who were given such information to provide services to the corporation whose securities they traded;

- government employees who learned of such information because of their employment by the government; and

- other persons who misappropriated, and took advantage of, confidential information from their employers.

SEC Insider Trading Enforcement Actions

- On September 21, 2016, hedge-fund manager Leon G. Cooperman and his firm, Omega Advisors, were charged with insider trading related to the sale of a company for $650 million. According to the SEC’s complaint, Cooperman learned of Atlas Pipeline Partners’ (“APL”) sale of its natural-gas processing facility from the company’s executive in advance of the public announcement. During this conversation, Cooperman allegedly told the executive that he would not to use the information for trading purposes. Thereafter, the hedge-fund manager purchased millions of dollars worth of APL’s stock, whose value increased by approximately 31% after the sale of the gas-processing facility. The SEC is seeking to disgorge all ill-gotten gains plus interest, penalties, and obtain permanent injunctions against Cooperman and Omega Advisors.

- On May 11, 2017, the SEC charged a former partner at an international law firm and his neighbor with making more than $1 million in illicit profits by insider trading around corporate announcements. According to the SEC’s complaint, the partner accessed confidential documents on his law firm’s internal computer network related to at least 11 impending announcements involving law firm clients. The partner traded with this material nonpublic information and often tipped his neighbor about the information as well. The neighbor similarly traded in company stocks before the announcements were made public.

- On May 24, 2017, the SEC charged a former government employee who tipped a political intelligence consultant about confidential information regarding upcoming decisions by the Centers for Medicare and Medicaid Services (CMS). The consultant relayed this information to analysts at a hedge fund advisory firm that paid him as a consultant. The analysts used the information to trade the stocks of four health care companies and generate more than $3.9 million in illicit profits.

- On July 12, 2017, the SEC announced charges against a scientist who used inside information about two acquisitions to make approximately $120,000 in unlawful profits. To avoid detection (unsuccessfully), Mr. Yuan placed the trades using a brokerage account opened in China bearing his mother’s name. The SEC’s investigation revealed several “smoking guns,” including Internet searches conducted by Mr. Yuan about how to evade detection, including a search for “insider trading in an international account.” Click here to read the complaint.

- On September 20, 2017, the SEC charged the former CEO of a Silicon Valley-based fiber optics company, Alliance Optics Products, with insider trading in company stock that generated $2 million in illicit profits and losses avoided. According to the SEC’s complaint, the CEO used secret brokerage accounts in the names of his wife and brother and trade company shares after attending board meetings where confidential information was discussed. In addition, the CEO tipped his brother about the company’s performance prior to earnings announcements as well as prior to an announcement that the company would be acquired by Corning.

Additional recent SEC enforcement actions for insider trading that have resulted in monetary sanctions in excess of $1 million include:

- SEC v. Thomas D. Melvin, et al.

- Securities and Exchange Commission v. Yu-Cheng Lin – $7.3 million

- SEC v. Sigma Capital Management, LLC – $14 million

SEC Whistleblower Reward Program

For more information about the SEC Whistleblower Program, see our eBook Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower Award. Click below to hear SEC whistleblower lawyer Matt Stock’s tips for SEC whistleblowers:

Whistleblower Protection for SEC Whistleblowers

The SEC Whistleblower Program also protects the confidentiality of whistleblowers and does not disclose information that might directly or indirectly reveal a whistleblower’s identity. Furthermore, the Dodd-Frank Act and Sarbanes-Oxley Act protect whistleblowers from retaliation by their employers for reporting violations of securities laws.

Click here to learn more about anti-retaliation protections for SEC whistleblowers under the Dodd-Frank Act and Sarbanes-Oxley Act.

Download our free guide Sarbanes-Oxley Whistleblower Protection: Robust Protection for Corporate Whistleblowers

Washington DC SEC Whistleblower Law Firm

The experienced whistleblower lawyers at Zuckerman Law represent whistleblowers worldwide before the SEC under the Dodd-Frank SEC Whistleblower Program. The firm has a licensed Certified Public Accountant and Certified Fraud Examiner on staff to enhance its ability to investigate and disclose complex financial fraud to the SEC. Firm Principal Jason Zuckerman has been named by Washingtonian Magazine as a “Top Whistleblower Lawyer” and the firm has been ranked by U.S. News as a Tier 1 Firm in Labor & Employment Litigation.

Whistleblower law firm Zuckerman Law has substantial experience investigating securities fraud schemes and preparing effective submissions to the SEC concerning a wide range of federal securities violations, including:

- Accounting fraud;

- Investment and securities fraud;

- EB-5 investment fraud;

- Manipulation of a security’s price or volume;

- Fraudulent securities offerings and Ponzi schemes;

- Unregistered securities offerings;

- Investment adviser fraud;

- False or misleading statements about a company or investment;

- Inadequate internal controls; and

- Violations of auditor independence rules.

For more information about the SEC Whistleblower Program, see the following resources:

Zuckerman Law’s Guide to the SEC Whistleblower Program (click the eBook below)

Zuckerman Law SEC Whistleblower Reward Program FAQ

whistleblower_lawyers_012017_infographic

Auditor Independence Whistleblower Lawyers

The Rule provides a nonexclusive list of specific circumstances that render an accountant nonindependent. This includes circumstances that:

- create a mutual or conflicting interest between the auditor and the client;

- place the auditor in the position of auditing his or her own work;

- result in the auditor’s acting as management or an employee of the client; or

- place the auditor in a position of being an advocate for the client.

Typically, independence cases arise from inappropriate financial or employment relationships between an auditor and a client. Recently, however, the SEC has targeted independence violations that stem from “inappropriate close personal relationships” between auditors and clients, including romantic relationships and excessive socializing.

Contact us today for a free, confidential consultation. to find out the strategies that we have successfully employed to secure SEC whistleblower awards for our whistleblower clients.

Purpose of Auditor Independence Rules

The independence rules are designed to ensure that auditors perform their work in an objective and impartial manner. By remaining independent in fact and appearance, auditors improve the reliability of information used for investment and credit decisions and strengthen public confidence in the financial markets.

As summarized in a motion filed in a case brought against Prager Metis, “Independence is a key principle of public accounting. Dating back to the inception of the securities laws, the Commission emphasized the need for auditors to be independent, including by avoiding contractual alliances with their public audit clients.”

SEC Enforcement Actions for Violations of Auditor Independence

In a speech, former SEC Enforcement Director Andrew Ceresney stressed that auditor independence “is an area of significant importance to the Commission.” He noted that in the past few years, the SEC has brought independence-related cases involving:

- the provision of bookkeeping and expert services to affiliates of audit clients (i.e., audit firms cannot loan their staff to audit clients in a manner that results in the staff’s acting as employees of those companies);

- audit personnel’s owning stock in audit clients or affiliates of audit clients (KPMG agreed to pay $8.2 million to settle the SEC’s charges);

- lobbying on behalf of audit clients (Ernst & Young (“EY”) agreed to pay more than $4 million to settle the charges);

- service by audit-firm employees or affiliates on boards of audit clients (Deloitte agreed to pay more than $1 million to settle the charges);

- preparation of financial statements of brokerage firms that were also audit clients (SEC sanctioned 8 audit firms for preparing the financial statements of brokerage firms that were their audit clients); and

- circumvention of the lead-audit-partner-rotation requirements (the lead partner is prohibited from performing lead-audit-partner services for the same issuer for more than 5 consecutive fiscal years).

In addition, the SEC has stepped up enforcement actions against inappropriately close personal relationships between auditors and clients.

PwC Paid $7.9 Million for Violating Auditor Independence Rules

On September 23, 2019, the SEC announced that PwC paid $7.9 million to settle charges of improper professional conduct in connection with 19 engagements on behalf of 15 SEC-registered issuers and violating auditor independence rules. The SEC found that “PwC violated the SEC’s auditor independence rules by performing prohibited non-audit services during an audit engagement, including exercising decision-making authority in the design and implementation of software relating to an audit client’s financial reporting, and engaging in management functions.”

“Close Personal Relationships” Lead to Violations of Independence Rules

In an SEC enforcement action, EY, a public accounting firm, agreed to pay $9.3 million to settle charges that two of the firm’s audit partners violated independence rules by getting too close to their clients on a personal level.

The SEC’s first complaint alleges that EY audit partner Gregory Bednar maintained an inappropriately close personal relationship with the chief financial officer (“CFO”) of an EY audit client. The relationship consisted of frequently attending social events together, exchanging gifts, and even taking numerous overnight, out-of-town trips together. The complaint notes that Bednar:

- gifted sports tickets to the CFO, the CFO’s family, or friends of the CFO’s son for use when Bednar was not present;

- took trips with the CFO;

- stayed at the CFO’s vacation home in Hilton Head, South Carolina;

- exchanged hundreds of personal texts, emails, and voicemails with the CFO that did not include meaningful business-related discussion; and

- incurred significant entertainment, travel, and lodging expenses while entertaining the CFO and his family.

The SEC found that the extent and nature of their socializing impaired the audit partner’s independence under Regulation S-X.

The SEC’s second complaint alleges that EY audit partner Pamela Hartford had a romantic relationship with Robert Brehl, the Chief Accounting Officer (“CAO”) of an EY audit client. The main EY partner on the audit engagement, Michael Kamienski, was aware of facts that indicated a possible romantic relationship between Hartford and the CAO. Despite this, Kamienski failed to identify those facts as red flags, failed to perform a reasonable inquiry regarding the extent of the relationship, and failed to raise concerns to EY’s U.S. Independence group.

The SEC brought charges against EY, Hartford, Kamienski, and Brehl. By including Kamienski in the action, the SEC underscored that auditors will not be able to avoid liability by burying their heads in the sand.

Recently, Zuckerman Law was quoted in a Compliance Week article titled “Audit committees need to dig into personal relationships,” which covered this enforcement action. Matthew Stock, former external auditor and current associate at Zuckerman Law, highlighted the impact that independence violations can have on external audit firms and issuers. In addition, he noted that audit committees must judge the significance of these relationships through the lens of whether a reasonable investor would consider them important when making investment decisions.

Primary Audit Deficiencies Identified in PCAOB Audit

Based on 780 issuer audits in 2016, the PCAOB identified the following audit deficiencies in a staff inspection brief:

- Assessing and responding to risks of material misstatement, including the fraud risk involving improper revenue recognition and the types of revenue, revenue transactions, or assertions that may give rise to such risks.

- Auditing internal controls over financial reporting, including “insufficient testing of the design and operating effectiveness of selected controls, particularly those controls that include a review element. Many of these deficiencies involved testing controls over management’s cash-flow forecasts or other assumptions that the issuer used in determining estimates related to revenue, business combinations, asset impairments, and reserves.”

- Auditing accounting estimates, including fair value measurements. “Audit deficiencies in this area have commonly related to evaluating impairment analyses for goodwill and other long-lived assets and the valuations of assets and liabilities acquired in business combinations. Other areas where deficiencies were identified include revenue-related estimates and reserves, the allowance for loan losses (“ALL”), inventory reserves, and financial instruments.”

Dodd-Frank SEC Whistleblower Reward Program

Qualifying for an SEC Whistleblower Award

If you have information that may qualify for an SEC whistleblower award, contact the Director of our SEC whistleblower practice at [email protected] or call our leading SEC whistleblower lawyers at (202) 930-5901 or (202) 262-8959. All inquiries are confidential. In conjunction with our courageous clients, we have helped the SEC halt multi-million dollar investment schemes, expose violations at large publicly traded companies and return funds to defrauded investors. Click below to hear SEC whistleblower lawyer Matt Stock’s tips for SEC whistleblowers:

Whistleblower Protections for Corporate Whistleblowers

The SEC Whistleblower Program also protects the confidentiality of whistleblowers. Furthermore, the Dodd-Frank Act protects whistleblowers from retaliation by their employers for reporting violations of securities laws.

In addition, the Sarbanes-Oxley Act provides robust protection for corporate whistleblowers. For information about the Sarbanes-Oxley whistleblower protection law, download our free guide titled Sarbanes-Oxley Whistleblower Protection: Robust Protection for Corporate Whistleblowers.

Tips to Successfully Navigate the SEC Whistleblower Process

SEC Whistleblower Lawyers

For more information about whistleblower rewards and bounties, contact the SEC whistleblower lawyers at Zuckerman Law at 202-930-5901 or 202-262-8959.

In contrast to most SEC whistleblower practices, our team includes a Certified Public Accountant and Certified Fraud Examiner with substantial experience auditing public companies and investigating complex fraud schemes. And two lawyers on our team served in senior positions at the U.S. Office of Special Counsel overseeing government investigations of whistleblower claims. We understand the many challenges that the SEC faces in investigating our clients’ disclosures and take measures to increase the likelihood that the SEC will be able to effectively pursue the disclosures we provide on behalf of our clients.

- Matt Stock is a Certified Public Accountant, Certified Fraud Examiner and former KPMG external auditor. As an auditor, Mr. Stock developed an expertise in financial statement analysis and internal controls testing and fraud recognition. He uses his auditing experience to help IRS, CFTC and SEC whistleblowers investigate and disclose complex financial frauds to the government and develop a roadmap for enforcement attorneys to take an enforcement action. Matt has been interviewed on CNBC, quoted extensively about whistleblower rewards in the media, and is the lead author of SEC Whistleblower Program: Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower Award. Recently the Association of Certified Fraud Examiners published a profile of Matt Stock’s success fighting fraud:

Auditor Independence Principles

In a brief filed in an audit independence enforcement action against Prager Metis for audit independence violations in connection with its audits of FTX, the SEC summarizes key principles of audit independence:

- Independence is a key principle of public accounting. Dating back to the inception of the securities laws, the Commission emphasized the need for auditors to be independent, including by avoiding contractual alliances with their public audit clients. See In the Matter of Am. Terminals and Transit Co., 1 S.E.C. 701, 1936 WL 32788 *6 (September 29, 1936) (protection of investors requires that independent auditors “be free of the entangling alliances which relational and contractual connections with registrants frequently engender, but also that they approach their task with complete objectivity—critical of the practices and procedures of registrants . . . .”).

The Supreme Court confirmed the Commission’s views and described independent public accountants as a “public watchdog” that must maintain total independence from the client at all times and complete fidelity to the public trust. Arthur Young & Co., 465 U.S. at 818 (public faith in the reliability of a corporation’s financial statements depends upon the public perception of the outside auditor as an independent professional). - Commission Rule 2-01 of Regulation S-X “is designed to ensure that auditors are qualified and independent of their audit clients both in fact and in appearance.” 17 C.F.R. § 210.2-01 (emphasis added). Rule 2-01(b) provides the general standard of auditor independence that: The Commission will not recognize an accountant as independent, with respect to an audit client, if the accountant is not, or a reasonable investor with knowledge of all relevant facts and circumstances would conclude that the accountant is not, capable of exercising objective and impartial judgment on all issues encompassed within the accountant’s engagement. In determining whether an accountant is independent, the Commission will consider all relevant circumstances, including all relationships between the accountant and the audit client, and not just those relating to reports filed with the Commission. 17 C.F.R. § 210.2-01(b).

- Engagement letters are not mere ordinary contracts for services. Audit engagement letters are themselves subject to prescribed audit standards. See PCAOB Auditing Standard (“AS”) 1301, Communications with Audit Committees, which, among other things, requires the auditor to communicate to the client’s audit committee the responsibilities of the auditor in relation to the audit and establish an understanding of the terms of the audit engagement with the audit committee . . . The engagement letter encapsulates a list of the responsibilities of both the auditor and management, and also refers to the professional standards by which the engagement will be governed and may also describe any limitations of the services being provided.

- Indemnification provisions between an auditing firm and its client create the very type of situation which lead to the appearance of a conflict of interest9 and lack of independence, regardless whether the indemnification provision was ever invoked.10 As the Commission has publicly explained, “if investorIn Commission enforcement actions, a finding of actual impairment or impairment in facts do not believe that an auditor is independent of a company, they will derive little confidence from the auditor’s opinion and will be far less likely to invest in that public company’s securities.” Revision of the Commission’s Auditor Independence Requirements, 2000 WL 1726933, at *2 (Nov. 21, 2000) (“Adopting Release”).

- In Commission enforcement actions, a finding of actual impairment or impairment in fact has not been required to allege a lack of auditor independence. One such example is found in In the Matter of Ernst & Young LLP et al. (“EY”), 2016 WL 4983302 (Sept. 19, 2016), a settled administrative and cease-and-desist proceeding. The EY matter was based on allegations under the general standard of independence that an auditing firm’s employee and member of the audit engagement team had a close personal relationship with the chief accounting officer at the audit client, which created the appearance of a violation of independence between auditor and client. Additionally, the prohibition of a close personal relationship with the audit client is not specifically identified in the non-exclusive circumstances that are inconsistent with independence in Rule 2-01(c) of Regulation S-X [17 C.F.R. § 210.2-01(c)] (“Rule 2-01(c)”); however, it is well understood that this is the type of relationship that would impair independence. The Commission has brought other cases based on alleged violations of the Commission’s independence rule for actions not specifically identified in Rule 2-01(c). See In the Matter of Ernst & Young LLP, 2021 WL 3410672 (Aug. 2, 2021) (settled order in administrative and cease-and-desist proceeding against auditing firm and its partners alleging independence violations related to competitive bid process); In the Matter of Ernst & Young LLP, 2014 WL 3401161 (July 14, 2014) (settled order in administrative and cease-and-desist proceeding against auditing firm alleging auditing firm improperly advocated for an audit client in violation of the Commission’s independence rules.).

Whistleblower Lawyers Representing Auditors

SEC Whistleblower Bounties

Whistleblower Protections for Auditors

whistleblower_lawyers_012017_infographic

Internal Control over Financial Reporting (ICFR)

Under federal law, publicly traded companies are responsible for devising and maintaining a system of internal accounting controls sufficient to reasonably assure that:

- transactions are executed in accordance with management authorization;

- transactions are recorded as necessary to:

- permit preparation of financial statements in conformity with GAAP; and

- maintain accountability for assets;

- access to assets is permitted only in accordance with management authorization; and

- recorded accountability for assets is compared with the existing assets at reasonable intervals, and appropriate action is taken regarding any differences.

SEC Whistleblower Program

Under the SEC Whistleblower Program, whistleblowers may be eligible for monetary awards when they voluntarily provide the SEC with original information about violations, including inadequate internal controls, that leads the SEC to bring a successful enforcement action that results in monetary sanctions exceeding $1 million. Whistleblowers are eligible to receive between 10% and 30% of the monetary sanctions collected. If represented by counsel, a whistleblower may submit a tip anonymously to the SEC.

Since 2012, the SEC Whistleblower Office has issued nearly $1 billion in awards to whistleblowers. The largest SEC whistleblower awards to date are $114 million and $50 million. See below for details about a $22 million award to an SEC whistleblower who exposed inadequate internal accounting controls.

In conjunction with our courageous clients, our SEC whistleblower lawyers have helped the SEC halt multi-million dollar investment schemes, expose violations at large publicly traded companies, and return funds to defrauded investors.

If you have original information that you would like to report to the SEC Office of the Whistleblower, contact the Director of our SEC Whistleblower Practice at [email protected] or call our leading SEC whistleblower lawyers at (202) 930-5901 or (202) 262-8959. All inquiries are confidential.

Qualifying for an SEC Whistleblower Award

For more information about the SEC Whistleblower Program, see our eBook Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower Award. Click below to hear SEC whistleblower lawyer Matt Stock’s tips for SEC whistleblowers:

Inadequate Internal Accounting Controls

Over the past few years, the SEC has increasingly enforced rules that require companies to maintain sufficient internal controls over financial reporting (“ICFR”). Despite this, a recent report by the Public Company Accounting Oversight Board (“PCAOB”) revealed that one of the most frequent audit deficiencies continues to be inadequate internal accounting controls. Violations include:

- failing to devise and maintain adequate internal controls, as specified under Section 13(b)(2)(B) of the Securities Exchange Act of 1934 (“Exchange Act”);

- failure by management to evaluate the effectiveness of ICFR as of the end of each fiscal year, as required by Exchange Act Rule 13a-15(c);

- failure to maintain evidential matter, including documentation, to provide reasonable support for management’s assessment of the effectiveness of the ICFR, as required by Item 308 of Regulation S-K; and

- invalid certifications by the executives and financial officers that confirm that the Form 10-Q or 10-K does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements not misleading in light of the circumstances under which the statements were made, as required by Exchange Act Rule 13a-14.

Purpose of Internal Accounting Controls

Maintaining adequate ICFR provides companies, investors, and other interested parties with reasonable assurance that misstatements, omissions, and fraud will timely be prevented or detected. This assurance is especially critical in a time when external auditors have consistently failed to identify flaws in public companies’ ICFRs.

In 2016, the PCAOB inspected 12 publicly traded companies audited by PwC and found deficiencies in 10 of the audits related to testing controls for purposes of the ICFR opinion. PwC revised its opinion on internal controls in 6 cases. At Deloitte, the PCAOB identified problems in the internal-control audit for all 13 of the audits selected.

As former SEC Chair Arthur Levitt recently noted in a Wall Street Journal op-ed, “[g]ood internal controls are essential bulwarks against sloppiness, errors and irregularities. An audit might make sure that inventories are reported accurately, or that vendors are legitimate, or that cybersecurity policies and antihacking protocols are implemented effectively. Auditors may review internal emails to detect potential fraud. They can see into the regular operations of a company and, if empowered, call out the kinds of mistakes or malfeasance that leads to major financial restatements and other market-moving events.” In cautioning against a proposal to exempt more companies from internal control audits, Chair Levitt notes that from 2014-16, exempted companies had a restatement rate of 11.2%, while similarly sized companies still subject to the audit requirements had a rate of 6.2%.

Internal Controls Prevent and Reveal Fraud

Recent ground-breaking research about internal control deficiencies underscores the critical role of internal controls in detecting and preventing fraud. In an August 2017 article titled Internal Control Weakness and Financial Reporting Fraud published in Auditing: A Journal of Practice & Theory, the authors demonstrate a strong correlation between material weaknesses and future fraud revelation. A summary of the article in CFO notes that about 30% of fraud revelations were preceded by reports of material weakness.

SEC Enforcement Actions

Inadequate Internal Accounting Controls Lead to $22M SEC Whistleblower Award

In a recent enforcement action, on August 30, 2016, the SEC issued a $22 million award to a whistleblower who exposed that Monsanto had inadequate internal accounting controls to account for millions of dollars in rebates. Monsanto’s deficient controls caused it to materially misstate its earnings during a 3-year period. While the SEC investigation found no personal misconduct, the company was fined $80 million for the accounting violations.

SEC Chairman Mary Jo White stated, “Financial reporting and disclosure cases continue to be a high priority for the Commission and these charges show that corporations must be truthful in their earnings releases to investors and have sufficient internal accounting controls in place to prevent misleading statements.”

Additional SEC Enforcement Actions Against Inadequate Internal Accounting Controls

Inaccurate Accounting of Reserves for Annuity Benefits

On December 18, 2019, MetLife, Inc. agreed to pay $10 million to settle charges that it violated the books and records and internal accounting controls provisions of the federal securities laws relating to two errors in its accounting for reserves associated with its annuities businesses. In particular, MetLife improperly released reserves for annuity benefits associated with MetLife’s Retirement and Income Solutions Business – that is, reducing liability for future policy benefits, which resulted in a corresponding increase in income. To correct the error, MetLife increased reserves by $510 million pre-tax. The SEC’s order also finds that MetLife overstated reserves and understated income relating to variable annuity guarantees assumed by a MetLife subsidiary. MetLife disclosed that this error was caused by data mistakes, including a failure to properly incorporate policyholder withdrawals into MetLife’s valuation model. To correct this error, MetLife reduced reserves by $896 million as of year-end 2017.

Failure to Report Tax Liabilities of Controlled Foreign Subsidiary

On January 23, 2017, Overseas Shipholding Group Inc. (OSG) agreed to pay $5 million fine to the SEC to settle charges it failed to report hundreds of millions of dollars in tax liabilities for over a decade. According to the SEC’s order, OSG and its former chief financial officer, Myles Robert Itkin, failed to report a controlled foreign subsidiary’s federal income tax liabilities in financial statements from 2000 through 2012. This failure caused the company to significantly understate its net loss in that same period and ultimately file for bankruptcy in 2012.

Gerald Hodgkins, Associate Director of the SEC’s Enforcement Division, stated “Where public companies derive economic benefits from their offshore earnings, it is critical that those responsible for the company’s accounting and financial reporting understand the federal income tax consequences triggered from these benefits.”

Improper Revenue Recognition

On January 11, 2017, the SEC fined an aerospace contractor, L-3 Technologies Inc., $1.6 million for improperly recording revenue on contracts. In late 2013, L-3 realized that it was at risk of not meeting its performance target. In order to inflate revenue, and in violation of L-3’s revenue recognition policy, the VP of Finance directed employees to generate roughly 69 invoices and then recognize $17,9 million in income. This extra revenue allowed L-3 to meet its performance target and qualify for incentive bonuses. This practice of improperly recognizing revenue was not uncommon.

In total, L-3’s inadequate internal controls for revenue recognition led to inflated pre-tax income of $169 million. This caused the company to amend its SEC filing in October 2014. SEC Director Andrew Calamari noted, “[a]dequate internal accounting controls function as a critical safeguard against the type of improper revenue recognition that occurred at L3.”

Failure to Maintain Adequate Internal Controls to Prevent Insider Trading

On August 21, 2017, hedge fund Deerfield Management Company L.P. paid approximately $4.6 million to settle charges that it failed to maintain adequate controls to prevent the misuse of inside information. According to the SEC’s complaint, a former government employee with inside information about upcoming CMS decisions concerning Medicare and Medicaid reimbursement rates related to cancer treatments or kidney dialysis tipped two analysts at a hedge fund. The hedge fund was paying him approximately $193,000 to provide political intelligence consulting. The hedge fund’s use of this suspicious information violated its procedures barring insider trading.

Insufficient Controls Resulting in Unauthorized Payments to Executives

On December 11, 2017, took enforcement action against a biotechnology company for its failure to maintain sufficient controls surrounding the reporting and disclosure of travel and entertainment expenses submitted by its executives. The company’s former CEO treated the company “as his personal piggy bank,” obtaining millions of dollars from the company using limited, fabricated, or non-existent expense documentation, and these unauthorized perks and benefits were not disclosed to investors. Examples include cosmetic surgery for friends and personal travel. The company’s “insufficient internal accounting controls contributed to and failed to detect these improper and unauthorized payments, which were not accurately recorded in the company’s books and records.”

SEC Whistleblower Rewards and Bounties

If you have information that may qualify for an SEC whistleblower award, contact the Director of our SEC whistleblower practice at [email protected] or call our leading SEC whistleblower lawyers at (202) 930-5901 or (202) 262-8959. All inquiries are confidential.

In conjunction with our courageous clients, we have helped the SEC halt multi-million dollar investment schemes, expose violations at large publicly traded companies, and return funds to defrauded investors. Read our tips for SEC whistleblowers and Forbes column about the success of the SEC whistleblower program.

As discussed in our articles, the SEC whistleblower program has become a very effective enforcement tool for the SEC. But very few whistleblowers have received awards, which underscores the importance of having experienced counsel represent a whistleblower effectively at the SEC.

- MarketWatch: More than 33,000 tips, $2.5 billion in financial remedies and $500 million in awards to investors — the SEC’s whistleblower program turns 10 years old today

- Going Concern: Here Are 6 Reasons Why the SEC Whistleblower Program Is Successful

- National Law Review: 5 Ways that Experienced SEC Whistleblower Law Firms Can Effectively Advocate for Whistleblowers

- D&O Diary: How the SEC Whistleblower Program Has Changed Corporate Compliance and SEC Enforcement

Whistleblower Protections for SEC Whistleblowers

The SEC Whistleblower Program also protects the confidentiality of whistleblowers and does not disclose information that might directly or indirectly reveal a whistleblower’s identity. And the Dodd-Frank Act protects whistleblowers from retaliation by their employers for reporting violations of securities laws to the SEC.

In addition, the whistleblower protection provision of the Sarbanes-Oxley Act protects disclosures about deficient internal controls. On the fifteenth anniversary of SOX, the SOX whistleblower lawyers at Zuckerman Law released a free guide to the SOX whistleblower protection law: Sarbanes-Oxley Whistleblower Protection: Robust Protection for Corporate Whistleblowers.

The guide summarizes SOX whistleblower protections and offers concrete tips for corporate whistleblowers based on lessons learned during years of litigating SOX whistleblower cases.

Download our guide to SOX whistleblower protection:

SEC Whistleblower Law Firm

For more information about whistleblower rewards and bounties, contact leading whistleblower law firm Zuckerman Law for a free, confidential consultation at 202-262-8959.

- See our column in Forbes: One Billion Reasons Why The SEC Whistleblower-Reward Program Is Effective.

- See our column in Going Concern: Sarbanes-Oxley 15 Years Later: Accountants Need to Speak Up Now More Than Ever.

- See our post in Accounting Today: Whistleblower Protections and Incentives for Auditors and Accountants.

Click here to read reviews and testimonials from former clients.

SEC Whistleblower Attorneys

SEC Whistleblower Process

Fraudsters Using EB-5 Immigrant Investor Program To Scam Investors

As detailed in a June 2018 Congressional hearing, there has been a rise in investment fraud in the EB-5 Immigrant Investor Program. The EB-5 program, administered by the U.S. Citizenship and Immigration Services (USCIS), provides a path to legal residency for foreigners who invest directly in a U.S. business or private regional centers that promote economic development in specific areas and industries. The purpose of the EB-5 program is to stimulate the U.S. economy through job creation and capital investment by foreign investors. Lately, however, marketers have used this investment-for-visa program to defraud investors.

In a typical scheme, a company/Regional Center and its fundraisers will solicit EB-5 investors with the promise of high rates of return or U.S. residency. In some instances, the companies will even guarantee that the investments are risk-free. In reality, many of these companies act as Ponzi schemes or other illegal operations. The common SEC violations (see examples below) arising out of EB-5 schemes include:

- False or misleading EB-5 advertisements in violation of Section 10(b)-5 of the Securities Exchange Act of 1934;

- Theft or misuse of investor funds in violation of Section 17(a) of the Securities Act of 1933; and

- Improper solicitation of investors by unregistered broker-dealers in violation of Section 15(a) of the Securities Exchange Act of 1934.

Due to the prevalence of EB-5 fraud, the SEC has released an investor alert to warn investors about potential scams in EB-5 offerings. Moreover, USCIS released its Annual Report to Congress, which noted that “fraud-in the form of embezzlement, securities violations, investment schemes, and criminal conduct-has plagued the Regional Center program since its inception.” According to a letter from Senator Grassley, the EB-5 program has become riddled with fraud and EB-5 groups are telling investors they have “bought off the White House.”

See our article: How to Report EB-5 Fraud and Earn an SEC Whistleblower Award.

SEC Whistleblower Program: Awards for Reporting EB-5 Fraud

Under the SEC Whistleblower Program, individuals can receive an award for exposing EB-5 fraud. In fact, the SEC has already issued a $14.7 million award to an individual who exposed a fraudulent EB-5 scheme.

In testimony on the EB-5 immigrant investor program, the SEC’s Associate Director, Division of Enforcement, stated: “The SEC is committed to investigating fraudulent investment schemes arising from the EB-5 program, and will remain focused on this area and the key participants who offer and sell these investments.”

We have successfully represented a whistleblower disclosing EB-5 fraud to the SEC. If you have information that may qualify for an SEC whistleblower award, contact the Director of our SEC whistleblower practice at [email protected] or call our leading SEC whistleblower lawyers at (202) 930-5901 or (202) 262-8959. All inquiries are confidential.

In conjunction with our courageous clients, we have helped the SEC halt multi-million dollar investment schemes, expose violations at large publicly traded companies and return funds to defrauded investors. Read our tips for SEC whistleblowers.

How to Qualify for an SEC Whistleblower Award

For more information about the SEC Whistleblower Program, see our eBook Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower Award. Click below to hear SEC whistleblower lawyer Matt Stock’s tips for SEC whistleblowers:

SEC EB-5 Enforcement Actions

In 2017 alone, the SEC brought enforcement actions against nearly $1 billion worth of EB-5 projects. A majority of these enforcement actions are against individuals or companies that misuse investors’ funds (see examples below). Notably, the scrutiny over EB-5 projects has only increased since then.

Improperly Advertising EB-5 Projects As “Risk-Free”

On July 26, 2016, the SEC obtained a $63.8 million judgment against an oil company for a scheme that targeted EB-5 investors. The SEC alleged in their complaint that Luca International Group, LLC and its entities (collectively, the “Luca Entities”), targeting investors in Asia to invest in unregistered offerings of securities. Luca Entities represented to investors that their money would be invested in oil and gas drilling operations, and that they could expect risk-free annual rates of return of 20-30 percent. Luca Entities deceived investors by misrepresenting that their operations as successful, all while knowing that the company was losing millions of dollars. Luca Entities maintained this deception by using money from new investors to make sham profit payments to earlier investors until its bankruptcy in August 2015.

Illegal Brokering of EB-5 Investments

On June 23, 2015, the SEC charged two firms (Ireeco LLC and Ireeco Limited) that illegally brokered more than $79 million of investments by EB-5 investors seeking U.S. residency. Ireeco LCC used its website to solicit EB-5 investors and provide them with the “information and education” they would need in choosing the right regional center to invest with. After securing foreign investors from the website, Ireeco LCC would then direct them to the same handful of regional centers that paid the company a commission averaging around $35,000 per investor. While raising money for EB-5 projects in the U.S., these two firms were not registered to legally operate as securities brokers. The SEC sought to disgorge all of the ill-gotten gains and subject the companies to civil penalties pursuant to Sections 21B and 21C of the Exchange Act.

For more information illegal payments to unregistered persons, click here for FINRA’s Rules.

Misusing EB-5 Investments: $72 Million

On December 27, 2016, the SEC charged a California-based attorney, Emilio Franscisco, with stealing money over $9.6 million from EB-5 investors. According to the SEC’s complaint, Franscisco raised $72 million from investors in China to invest in EB-5 projects that included opening Caffe Primo restaurants, developing assisted living facilities, and renovating a production facility for environmentally friendly agriculture and cleaning products. Instead of using investors’ funds for the EB-5 projects, Franscisco used the money to purchase a yacht, and finance his own businesses and luxury lifestyle.

Misusing EB-5 Investments: $136 Million

On January 11, 2017, the SEC received a settlement offer from real estate developer and former Tibetan monastery student, Lobsang Dargey, in a $136 million EB-5 fraud case. This could signal a possible resolution to the high-profile case. In late 2015, the SEC ordered an asset freeze against Dargey and his “Path America” companies after raising at least $135 million for two real estate projects. Instead of properly investing the money, Dargey diverted $14 million for unrelated real estate projects and $3 million for personal use including the purchase of his $2.5 million home and cash withdrawals at casinos.

On April 28, 2017, the SEC posted the case on its “Notice of Covered Actions” page where all actions resulting in monetary sanctions exceeding $1 million are listed. Once a notice is posted, whistleblowers and their attorneys have 90 calendar days to apply for an award. For a link to the SEC’s complaint against Dargey and his Path America companies, click here.

Misusing EB-5 Investments: $100 Million

On January 18, 2017, the SEC charged California-based San Francisco Regional Center, LLC and owner Thomas Henderson with combining over $100 million he raised from EB-5 investors into a general fund from which he allegedly misused at least $9.6 million to purchase his home and personal items and improperly fund several personal business projects that were unrelated to the companies he purportedly established to create jobs consistent with EB-5 requirements. Furthermore, Henderson used $7.5 million of investor money to pay overseas marketing agents, and he shuffled millions of dollars among the EB-5 businesses to obscure his fraudulent scheme.

Misusing EB-5 Investments: $26.9 Million

On February 16, 2017, the SEC recommended a $65.7 million penalty against a husband and wife who allegedly misappropriated the bulk of $26.9 million raised in an EB-5 investment project. According to the SEC’s complaint, the couple defrauded at least 50 Chinese investors by falsely claiming that their monies would be invested in an approved EB-5 project to build and operate a proton therapy cancer treatment center (Beverly Proton Center, LLC) in Southern California. Rather than invest the money, the couple misappropriated at least $7.7 million for themselves and transferred more than $11.8 million to three marketing firms in China, including $3.5 million to a firm of which the husband is CEO and chairman of the board.

Misusing EB-5 Investments: $50 Million