Yes, a disclosure about a misleading earnings projection that leads the SEC to take an enforcement action that recovers more than $1M in sanctions will qualify for an SEC whistleblower award.

Experienced SEC whistleblower attorneys can provide critical guidance and effective advocacy to whistleblowers to increase the likelihood that they not only obtain, but also maximize their awards. Contact the SEC whistleblower attorneys at Zuckerman Law to learn how we have achieved successful outcomes for whistleblowers at the SEC.

In conjunction with our courageous clients, our SEC whistleblower lawyers have helped the SEC halt multi-million dollar investment schemes, expose violations at large publicly traded companies, and return funds to defrauded investors.

Recently the Association of Certified Fraud Examiners published a profile of Matt Stock’s success working with whistleblowers to fight fraud:

Misleading Earnings Guidance Leads to $34.5 Million Penalty

In June 2012, Walgreens announced that it was entering into a merger with Alliance Boots and also announced a projected FY16 adjusted operating income (EBIT) of $9 to $9.5 billion for the fully combined entity. Walgreens knew in 2012 that this goal was challenging by design and intended to provide quarterly updates to market analysts and investors on its progress towards reaching that goal.

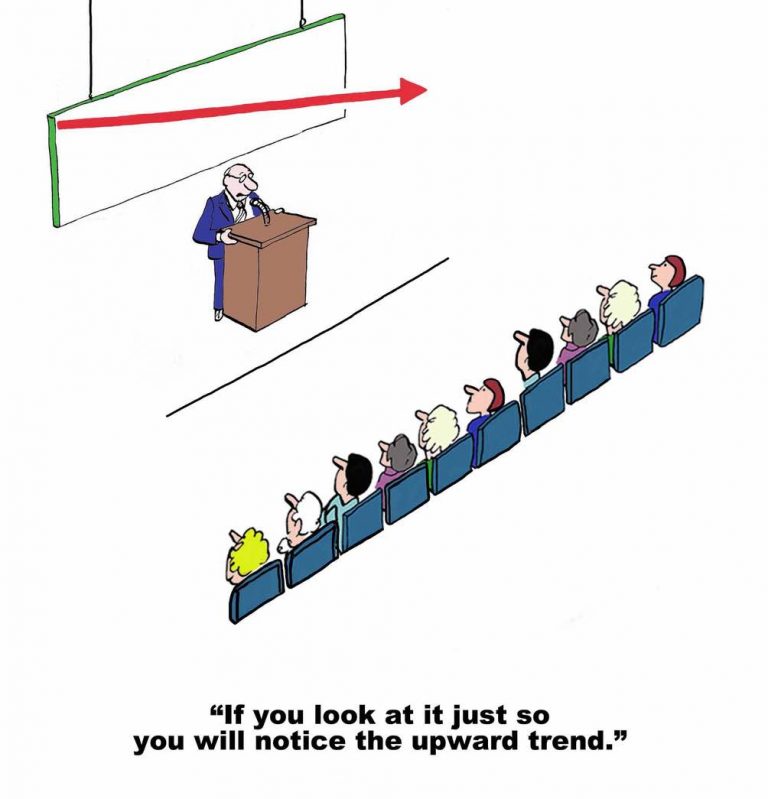

By May 2013, internal forecasts trailed expectations and it appeared that the company would miss the projected FY16 EBIT goal. In particular, poor retail sales and lagging pharmacy prescriptions in 2013 placed pressure on projected 2014 and 2015 EBIT, and by October 2013, Walgreens’ FY16 EBIT forecast dropped to approximately $8.7 billion, $300 million short of the low-end of the FY16 EBIT goal range. Yet in subsequent quarterly earnings calls in June 2013 and October 2013, CEO Gregory Wasson and CFO Wade Miquelon failed to disclose the internal forecasts and instead continued to reaffirm the FY16 EBIT goal.

It was not until December 2013 that Walgreens informed investors of an increased risk to achieving the FY16 EBIT goals. However, in both the December 2013 and March 2014 earnings calls, the extent of the increased risk to the FY16 goal was still not fully disclosed. Walgreens waited until a June 2014 earnings call to withdraw its FY16 EBIT projection, citing uncertainty regarding the structure of the company’s exercise of step two of the Alliance Boots merger and performance issues.

As the second step of the two-step merger was moving forward in August 2014, Walgreens announced a new adjusted operating income projection of $7.2 billion for FY16, a $2 billion reduction in operating income projection. That 20 percent decline from initial projections caused the stock price to drop 14.3% on the day of the announcement. According to the SEC Order, a member of Walgreens’ investor relations function found that various investors were “shocked at the EBIT shortfall and in particular, how quickly it happened.”

The SEC found that Walgreens violated Section 17(a)(2) of the Securities Act of 1933, “which prohibits a person, in the offer or sale of any securities, from obtaining money or property by means of any untrue statement of a material fact or any omission to state a material fact necessary to make the statements made, in light of the circumstances under which they were made, not misleading.”

In contrast to other anti-fraud provisions of the federal securities, the SEC need not prove scienter to establish a violation of 17(a)(2) of the 1933 Act. The prohibitions in Section 17(a)(2) focus upon the effect of particular conduct on members of the investing public, rather than upon the culpability of the person responsible. Accordingly, proof of negligence alone will suffice to establish a violation.

Walgreens Boots Alliance is paying a $34.5 million penalty, and Wasson and Miquelon are each paying a $160,000 penalty.

SEC Whistleblower Program

Under the SEC Whistleblower Program, a whistleblower may receive an award for providing the SEC with original information about violations that leads the SEC to bring a successful enforcement action that results in monetary sanctions exceeding $1 million. Whistleblowers are eligible to receive between 10% to 30% of the monetary sanctions collected.

Since 2012, the SEC has issued $1.3 billion in awards to whistleblowers, which includes awards to our clients totaling millions of dollars. SEC whistleblower attorneys can provide critical guidance to whistleblowers throughout this process to increase the likelihood that they not only obtain, but maximize, their awards.

To learn more about the SEC Whistleblower Program, download the eBook SEC Whistleblower Program: Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower Award.