Yesterday the SEC published for public comment its Draft Strategic Plan, which outlines the agency’s strategic goals. In discussing the goal of promptly detecting and deterring violations of federal securities laws, the Draft Strategic Plan identifies the Dodd-Frank Act’s whistleblower reward provision as a critical initiative in combatting securities fraud:

The SEC will continue to encourage individuals and entities with timely, credible and specific information about potential securities law violations to provide information to the Commission to further investigations and promote more efficient use of the Commission’s limited resources. Pursuant to the Dodd-Frank Act, the SEC is required to compensate eligible whistleblowers with an award of 10 to 30 percent of amounts collected as a result of original information provided by a whistleblower that leads to a successful enforcement action resulting in monetary sanctions exceeding $1,000,000.

The SEC Office of the Whistleblower 2013 Annual Report indicates that the SEC’s whistleblower reward program significantly enhances the SEC’s ability to act swiftly to protect investors from harm and hold violators accountable. In 2013, the SEC awarded over $14 million to a whistleblower whose information led to an SEC enforcement action that recovered substantial investor funds. The information provided by the whistleblower enabled the SEC to bring an enforcement action less than six months after receiving the whistleblower’s disclosure. According to the report, the SEC has received 6,573 tips and complaints from whistleblowers.

SEC Whistleblower Bounties

Qualifying for an SEC Whistleblower Award

Experienced SEC Whistleblower Attorneys

The experienced whistleblower lawyers at Zuckerman Law represent whistleblowers worldwide before the SEC under the Dodd-Frank SEC Whistleblower Program. The firm has a licensed Certified Public Accountant and Certified Fraud Examiner on staff to enhance its ability to investigate and disclose complex financial fraud to the SEC, and two of the firm’s attorneys served on the Department of Labor’s Whistleblower Protection Advisory Committee and in senior leadership positions at a government agency that protects whistleblowers.

Firm Principal Jason Zuckerman has been named by Washingtonian Magazine as a “Top Whistleblower Lawyer” and the firm has been ranked by U.S. News as a Tier 1 Firm in Labor & Employment Litigation.

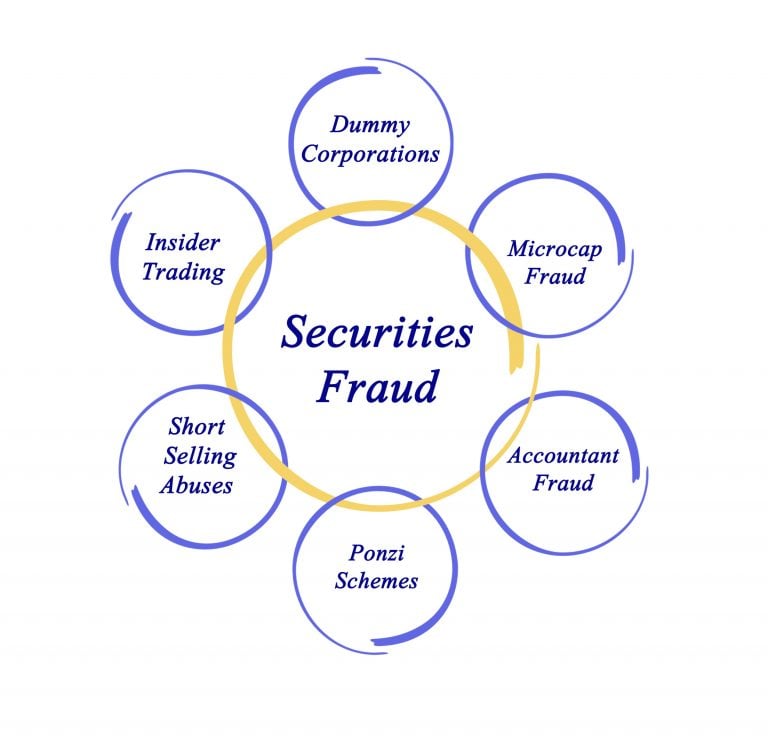

Leading whistleblower law firm Zuckerman Law has substantial experience investigating securities fraud schemes and preparing effective submissions to the SEC concerning a wide range of federal securities violations, including:

- Accounting fraud;

- Investment and securities fraud;

- EB-5 investment fraud;

- Manipulation of a security’s price or volume;

- Fraudulent securities offerings and Ponzi schemes;

- Unregistered securities offerings;

- Investment adviser fraud;

- False or misleading statements about a company or investment;

- Inadequate internal controls; and

- Violations of auditor independence rules.

For more information about the SEC Whistleblower Program, download our free ebook SEC Whistleblower Program: Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower Award.

For more information about whistleblower rewards and bounties, click here and contact the SEC whistleblower lawyers at Zuckerman Law at 202-262-8959.