SEC Targets Disclosure Fraud

Under the SEC Whistleblower Program, whistleblowers can obtain a reward for reporting original information to the SEC about violations of federal securities laws, including misleading or inadequate disclosures. We have successfully represented SEC whistleblowers that provided information to the SEC about disclosure fraud.

The SEC has awarded nearly $1.3 billion in awards to whistleblowers. The largest SEC whistleblower award to date, $114 million, was issued to a whistleblower who provided the SEC with key information that led to a successful enforcement action.

If you have information that may qualify for an SEC whistleblower award or have suffered whistleblower retaliation, contact the Director of our SEC whistleblower practice at [email protected] or call our leading SEC whistleblower lawyers at (202) 930-5901 or (202) 262-8959.

All inquiries are confidential. In conjunction with our courageous clients, we have helped the SEC halt multi-million dollar investment schemes, expose violations at large publicly traded companies and return funds to defrauded investors. Our SEC whistleblower lawyers have obtained multi-million dollar SEC whistleblower awards for our clients. Read our tips for SEC whistleblowers.

On September 22, 2022, the SEC charged The Boeing Company and its former CEO with making materially misleading public statements following crashes of Boeing airplanes. According to the SEC’s orders, after the first crash, Boeing and Muilenburg knew that MCAS posed an ongoing airplane safety issue, but nevertheless assured the public that the 737 MAX airplane was “as safe as any airplane that has ever flown the skies.” Later, following the second crash, Boeing and Muilenburg assured the public that there were no slips or gaps in the certification process with respect to MCAS, despite being aware of contrary information. Boeing and the former CEO entered into cease-and-desist orders that included penalties of $200 million and $1 million, respectively.

Gurbir S. Grewal, Director of the SEC’s Enforcement Division stated: “[P]ublic companies and their executives must provide accurate and complete information when they make disclosures to investors, no matter the circumstances. When they don’t, we will hold them accountable, as we did here.”

“Original Information” Based on Independent Analysis

For example, Regulation G and Item 10(e) of Regulation S-K govern the presentation of companies’ non-GAAP financial measures. These regulations require, among other things, that companies using a non-GAAP measure in their filings include:

- A presentation of the most directly comparable GAAP financial measure, with that presentation having equal or greater prominence than the disclosed non-GAAP measure; and

- A reconciliation showing the differences between the non-GAAP measure and the most directly comparable financial measure calculated in accordance with GAAP.

Accordingly, if an investor notices that either requirement is amiss from a company’s filings, he or she may submit a tip to the SEC and be eligible for an award. In early 2016, the SEC issued a $700,000 award to a whistleblower for his or her detailed analysis that led to a successful SEC enforcement action.

SEC Enforcement Actions Based on Deficient Internal Controls

There are many examples of SEC enforcement actions based on inadequate disclosures. These include actions for

- accounting violations;

- deceptive non-GAAP financial measures;

- inadequate internal controls;

- investment fraud; and

- foreign bribery or FCPA violations.

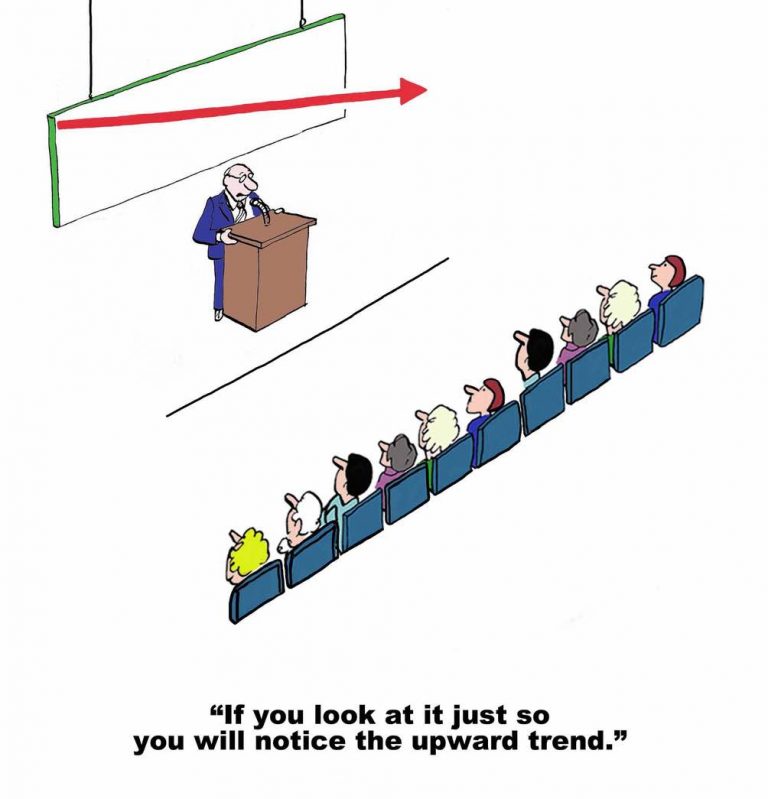

As Warren Buffett has warned, companies are using non-GAAP numbers to artificially boost earnings. We expect to see an increase in SEC enforcement in this area of inadequate disclosures and have brought whistleblower tips to the SEC disclosing the use of deceptive non-GAAP financial measures.

For example, in December 2015, two JP Morgan wealth management subsidiaries agreed to pay $267 million to settle charges that they failed to disclose conflicts of interest to clients. According to the SEC order, the investment advisory business and the bank invested clients in the firm’s own proprietary investment products without properly disclosing this preference. Morgan Stanley was fined $50 million for similar inadequate disclosures in 2003.

On February 14, 2017, the SEC fined groups of investors that failed to properly disclose ownership information during a series of campaigns to influence or exert control over microcap companies. In each of these campaigns, the groups collectively owned more than five percent of the companies’ outstanding common stock, yet the required ownership filings to disclose that information to the investing public were either incomplete, untimely, or altogether absent. The investors agreed to penalties ranging from $30,000 to $180,000.

On May 11, 2017, the SEC announced that the former CEO of MDC Partners, Miles S. Nadal, has agreed to pay $5.5 million to settle charges that his perks were not properly disclosed to shareholders. In public companies, all perks, benefits, and other forms of compensation paid to CEOs and highly compensated executive officers must be disclosed. According to the SEC’s order, Nadal obtained nearly $11 million in perks beyond his disclosed benefits and $500,000 annual allowance. This included Nadal’s personal use of private airplanes, charitable donations in his name, yacht and sports car expenses, cosmetic surgery, and a wide range of other perks. Earlier in 2017, MDC Partners agreed to settle this disclosure failure for $1.5 million.

SEC Whistleblower Rewards and Bounties

SEC Whistleblower Lawyers

The SEC Whistleblower Program also protects the confidentiality of whistleblowers and does not disclose information that might directly or indirectly reveal a whistleblower’s identity. Furthermore, the Dodd-Frank Act protects whistleblowers from retaliation by their employers for reporting violations of securities laws.

Recently the Association of Certified Fraud Examiners published a profile of Matt Stock’s success working with whistleblowers to fight fraud:

U.S. News and Best Lawyers® have named Zuckerman Law a Tier 1 firm in Litigation – Labor and Employment in the Washington DC metropolitan area in the 2022 edition “Best Law Firms.”

SEC Whistleblower Process to Obtain an SEC Whistleblower Award

Protections for SEC Whistleblowers

Drawing on substantial experience representing corporate whistleblowers in SOX whistleblower cases, our SOX whistleblower lawyers have published a free guide to SOX titled Sarbanes-Oxley Whistleblower Protection: Robust Protection for Corporate Whistleblowers:

whistleblower_lawyers_012017_infographic