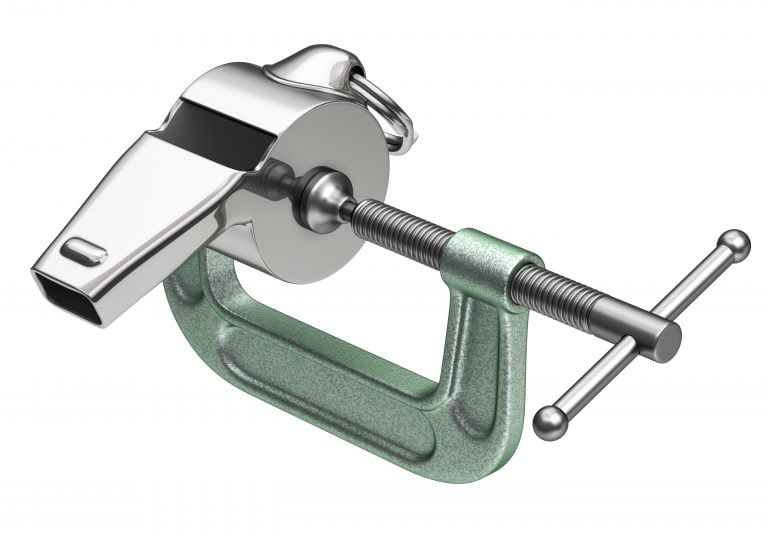

Remedies for SEC Whistleblower Retaliation

As recent SEC orders announcing whistleblower awards reveal, retaliation against SEC whistleblowers is prevalent. When a whistleblower suffers retaliation, we can help them remedy retaliation under federal and state whistleblower protection laws, including the anti-retaliation provisions of the Dodd-Frank Act and Sarbanes-Oxley Act.

In addition, the SEC has prioritized protecting whistleblowers against retaliation and has taken enforcement action against companies for violating the whistleblower protection provision of the Dodd-Frank Act. For example, the SEC ordered IGT to pay $500,000 for retaliating against a whistleblower.

Click here to learn more about anti-retaliation protections for SEC whistleblowers under the Dodd-Frank Act and Sarbanes-Oxley Act.

We have represented whistleblowers at the SEC for more than a decade. Our team of seasoned whistleblower attorneys understands the risks that our courageous clients take to do the right thing. We are committed to obtaining the maximum damages for corporate whistleblowers that have suffered retaliation.

If you are seeking representation in a whistleblower matter, click here, or call us at 202-262-8959 to schedule a free, confidential consultation.

Washingtonian magazine named two of our attorneys top whistleblower lawyers, and U.S. News and Best Lawyers® have named Zuckerman Law a Tier 1 firm in Litigation – Labor and Employment in the Washington DC metropolitan area.

Click here to read reviews from clients that we have represented in whistleblower rewards and whistleblower retaliation matters.

See our tips to get the maximum damages in your whistleblower retaliation case.

Dodd-Frank SEC Whistleblower Protection Provision

The whistleblower protection provision of the Dodd-Frank Act prohibits retaliation against a whistleblower for lawful actions taken by a whistleblower:

- in providing information to the Commission in accordance with this section;

- in initiating, testifying in, or assisting in any investigation or judicial or administrative action of the Commission based upon or related to such information; or

- in making disclosures that are required or protected under the Sarbanes-Oxley Act of 2002 (15 U.S.C. [§§] 7201 et seq.), this chapter, including section 78j-1(m) of this title, section 1513(e) of Title 18, and any other law, rule, or regulation subject to the jurisdiction of the Commission.

15 U.S.C. § 78u-6(h)(1)(A). A prevailing whistleblower can secure reinstatement and recover double back pay and compensation for litigation costs, expert witness fees, and reasonable attorneys’ fees.

In February 2018, the Supreme Court held in Somers that the anti-retaliation provision of the Dodd-Frank Act protects a whistleblower only where the whistleblower has disclosed a potential securities law violation to the SEC. Somers also clarified that once an employee has provided information to the SEC, subsequent internal disclosures are protected absent proof that the employer had knowledge of the disclosure to the SEC.

Post Somers, the SEC has indicated that it will continue to prioritize whistleblower protection as a key tool to encourage whistleblowers to come forward. In a June 28, 2018 public statement at the open meeting announcing the Proposed Rulemaking, Chair Clayton stated: “Many have asked whether the SEC will continue to enforce the anti-retaliation provisions of Dodd-Frank. Let me be clear: retaliation protections are a key component of the whistleblower program, and we will bring charges against companies or individuals who violate the anti-retaliation protections when appropriate.” Statement at Open Meeting on Amendments to the Commission’s Whistleblower Program Rules.

Protections for SEC Whistleblowers Post-Digital Realty (11-6-2020)SEC Enforcement of Dodd-Frank SEC Whistleblower Retaliation Provision

The action against IGT was the SEC’s first standalone retaliation case. However, it is consistent with a 2014 enforcement action that indicated, for the first time, that retaliating against a whistleblower can result not only in a private suit brought by the whistleblower but also in a unilateral SEC enforcement action. On June 16, 2014, the SEC announced that it was taking enforcement action against Paradigm Capital Management, Inc. (“Paradigm”), a hedge fund advisory firm, for engaging in prohibited principal transactions and for retaliating against the whistleblower who disclosed the unlawful trading activity to the SEC. See Exchange Act Release No. 72393 (June 16, 2014). This was the first case in which the SEC exercised its authority under Dodd-Frank to bring enforcement actions based on retaliation against whistleblowers.

According to the order, Paradigm retaliated against its head trader for disclosing, internally and to the SEC, prohibited principal transactions with an affiliated broker-dealer while trading on behalf of a hedge fund client. The transactions were a tax-avoidance strategy under which realized losses were used to offset the hedge fund’s realized gains.

When Paradigm learned that the head trader had disclosed the unlawful principal transactions to the SEC, it retaliated against him by removing him from his position as head trader, changing his job duties, placing him on administrative leave, and permitting him to return from administrative leave only in a compliance capacity, not as head trader. The whistleblower ultimately resigned his position.

Paradigm settled the SEC charges by consenting to the entry of an order finding that it violated the anti-retaliation provision of Dodd-Frank and committed other securities law violations; agreeing to pay more than $1 million to shareholders and to hire a compliance consultant to overhaul their internal procedures; and entering into a cease-and-desist order.

The SEC’s press release accompanying the order includes the following statement by Enforcement Director Andrew Ceresney: “Those who might consider punishing whistleblowers should realize that such retaliation, in any form, is unacceptable.” The Paradigm enforcement action suggests that whistleblower retaliation can result in liability far beyond the damages that a whistleblower can obtain in a retaliation action and that retaliation can invite or heighten SEC scrutiny.

Sarbanes-Oxley Protection for SEC Whistleblowers

To succeed in a Sarbanes-Oxley retaliation claim, the whistleblower must show by a preponderance of the evidence that

- she had engaged in protected whistleblowing activity;

- the company was aware of her protected activity;

- she suffered an unfavorable personnel action; and

- her protected activity was a “contributing factor” in the unfavorable action.

“Contributing factor” causation is a light burden that can be met by showing that protected activities tended to affect in any way the decision to take the adverse action.

Once the whistleblower makes that showing, the company can avoid liability only by proving by clear and convincing evidence that it would have taken the same adverse action even in the absence of the protected activity.

Zuckerman Law has represented CEOs, CFOs, in-house counsel, partners at audit firms and other senior professionals in high-stakes whistleblower retaliation matters. Drawing on our substantial experience representing corporate whistleblowers, we have published a free guide to SOX titled Sarbanes-Oxley Whistleblower Protection: Robust Protection for Corporate Whistleblowers:

Protected Whistleblowing Under the Sarbanes-Oxley Act

- Who is protected under the whistleblower protection provision of the Sarbanes-Oxley Act?

- What whistleblowing disclosures are protected under the Sarbanes-Oxley Act?

- What are examples of SOX-protected activity (protected whistleblowing)?

- Does the Sarbanes-Oxley Act protect whistleblowing about potential violations of federal securities laws?

- Are SOX whistleblowers required to show that their disclosures relate “definitively and specifically” to a federal securities law?

- Is an employee’s participation in an investigation of corporate fraud protected under the Sarbanes-Oxley Act?

- What are some types of proof to show that a disclosure is objectively reasonable?

- Is a whistleblower’s motive for engaging in protected activity relevant in a whistleblower protection case?

- Does the Sarbanes-Oxley protected conduct require a showing of materiality?

- Is a Sarbanes-Oxley whistleblower required to prove fraud?

- Are disclosures made in the course of performing one’s job duties protected?

- Must a SOX whistleblower prove that the individual who made the final decision to take the adverse action has personal knowledge of the whistleblower’s protected activity?

- Does the Sarbanes-Oxley whistleblower law protect employees working outside the United States?

Prohibited Whistleblower Retaliation Under Sarbanes-Oxley

- What acts of retaliation are prohibited by the Sarbanes-Oxley whistleblower protection law?

- Is constructive discharge a prohibited act of retaliation under SOX?

- Does SOX prohibit employers from “outing” confidential whistleblowers?

- Is retaliation that occurred outside of the statute of limitations period relevant evidence of retaliation?

- Does subjecting an employee to heightened scrutiny evidence retaliation?

- Does SOX prohibit post-termination retaliation?

- What is preemptive retaliation?

Proving Sarbanes-Oxley Whistleblower Retaliation

- What is a whistleblower’s burden to prove retaliation under the Sarbanes-Oxley Act?

- How can a whistleblower prove retaliation?

- Must a whistleblower prove retaliatory motive in a DOL whistleblower retaliation case?

- Why should courts be skeptical of an adverse employment action taken based on subjective criteria?

- What are some methods to prove pretext in retaliation and discrimination cases?

- Does a SOX whistleblower need to prove that the employer’s reason for the adverse action is untrue?

- What is the employer’s burden in a Sarbanes-Oxley whistleblower retaliation case?

- Does subjecting an employee to heightened scrutiny evidence retaliation?

Relief or Damages for SOX Whistleblowers

- What damages can a whistleblower recover under SOX?

- Does the Sarbanes-Oxley whistleblower protection law authorize emotional distress damages?

- What is front pay?

- Can OSHA order the reinstatement of a Sarbanes-Oxley whistleblower?

- If reinstatement is not feasible, can a judge award front pay in lieu of reinstatement?

- Does SOX authorize an award of punitive damages?

Litigating Sarbanes-Oxley Whistleblower Cases

- Can I sue an individual under the Sarbanes-Oxley Act?

- What is the statute of limitations for a SOX whistleblower retaliation case?

- Who administers the whistleblower-protection provision of SOX?

- What level of detail is required in a Sarbanes-Oxley complaint?

- Can a Sarbanes-Oxley whistleblower bring a retaliation case in federal court?

- Does the Sarbanes-Oxley Act authorize jury trials?

- Where are SOX whistleblower cases litigated?

- Do formal rules of evidence apply in Sarbanes-Oxley whistleblower trials at the Department of Labor?

- What is the scope of discovery in a Sarbanes-Oxley whistleblower case?

- What is the “reasonable cause” standard in an OSHA whistleblower investigation?

- Can a Sarbanes-Oxley whistleblower appeal an Administrative Law Judge’s decision?

- Where can a Sarbanes-Oxley whistleblower appeal a decision of the Administrative Review Board?

- Do mandatory arbitration agreements encompass SOX whistleblower claims?

- Does OSHA prohibit gag clauses in settlement agreements?

- Does Section 806 of SOX preempt other claims or remedies?

Section 1985 Haddle Remedy for Conspiracy to Interfere with Civil Rights of SEC Whistleblowers

At-will employees that suffer retaliation for participating in a federal court proceeding can bring claims under 42 U.S.C. § 1985(2). This civil rights statute prohibits conspiracies to intimidate or retaliate against parties, witnesses or jurors testifying or participating in federal court proceedings. Under 42 U.S.C. § 1985(2), a victim of intimidation or retaliation who suffers injury to “his person or property” can recover damages against the perpetrators of the conspiracy. The Supreme Court held in Haddle v. Garrison, 525 U.S. 121 (1998) that a conspiracy to terminate an employee’s at-will employment constitutes injury to person or property and is therefore actionable under 42 U.S.C. § 1985(2).

RICO Prohibition Against SEC Whistleblower Retaliation

Section 1107 of SOX, 18 U.S.C. § 1513(e), criminalizes whistleblower retaliation. It provides:

Whoever knowingly, with the intent to retaliate, takes any action harmful to any person, including interference with the lawful employment or livelihood of any person, for providing a law enforcement officer any truthful information relating to the commission or possible commission of any federal offense, shall be fined under this title, imprisoned not more than 10 years, or both.

As Section 1513(e) is a predicate offense under the Racketeer Influenced and Corrupt Organizations Act (RICO), there is a private right of action to remedy a violation of 1513(e). Protected conduct includes reporting a possible criminal securities law violation to the SEC. RICO is a potent remedy because it authorizes treble damages. 18 U.S.C. § 1964(c).

In DeGuelle v. Camilli, 664 F.3d 192 (7th Cir. 2011), DeGuelle, a tax employee of S.C. Johnson & Son, Inc. (“SCJ”), was terminated after reporting an alleged tax scheme to his employer and federal agencies. Over an eight year period beginning in 2001, DeGuelle relayed a series of concerns regarding SCJ tax practices to Daniel Wenzel, Global Tax Counsel of SCJ. Wenzel directed DeGuelle to alter or destroy documents to avoid detection of a tax issue that DeGuelle brought to Wenzel also instructed DeGuelle and another employee to fabricate a business transaction in order to exploit accounting rules for the company’s benefit. DeGuelle finally met with Camilli, Director of Human Resources, to discuss that Wenzel was creating a hostile work environment. DeGuelle also spoke with Gayle Kosterman who informed DeGuelle that the company hired a law firm to investigate his tax fraud allegations and DeGuelle spoke with attorneys from the firm.

Wenzel told DeGuelle to keep his complaints about the tax department within the department, instead of taking them to human resources. Wenzel made disparaging comments towards DeGuelle in front of other employees and acted aggressively towards him. DeGuelle received a negative performance review, which was conducted off-cycle and at odds with the award he received earlier that year recognizing his stellar performance. On September 10, 2008, DeGuelle and Camilli met again to discuss DeGuelle’s safety concerns relating to Wenzel’s behavior. Later that month, DeGuelle and Wenzel had another verbal altercation and DeGuelle received a negative review from Wenzel. DeGuelle spoke with Camilli alleging that the negative review was in retaliation for his whistleblowing, which she said she would investigate. In November, DeGuelle contacted Camilli in writing to inform her that if the company did not take action, he would contact state or federal authorities regarding the retaliation. On December 18, 2008 DeGuelle was informed that the negative review was retaliatory and would be revoked. DeGuelle was directed to drop his tax fraud complaints, but DeGuelle said he would file a whistleblower complaint with the Department of Labor. The company offered a salary increase and offered to pay part of his attorney fees if he signed a confidentiality agreement and release of claims. Instead, on December 18, 2008, DeGuelle filed a complaint under SOX with the Department of Labor, attaching tax documents, financial statements and internal communications to his complaint. In January 2009, DeGuelle met with Kosterman to withdraw his salary request, fearing that it could be viewed as an attempt to profit from the company’s tax fraud. On February 17, 2009, the DOL determined that SCJ was not a covered entity under SOX. Id. at 197.

On March 10, 2009 SCJ sent another fraudulent tax return to the IRS. On March 19, 2009 DeGuelle sent a memorandum detailing his concerns to SCJ counsel, after which Kosterman offered him a year’s salary if he were to resign and signed a confidentiality agreement and released all claims. On April 9, 2009, SCJ began investigating DeGuelle for disclosing confidential company documents. DeGuelle met with Camilli and other investigators and denied disclosing documents, but admitted that he attached them to the DOL complaint, asserting that Camilli was aware of those disclosures. After that meeting, Kosterman and another employee placed DeGuelle on administrative leave, ultimately terminating him for taking and disclosing confidential business documents. SCJ filed suit in Racine County Circuit court seeking recovery of SCJ property and confidential information and for breach of contract and conversion. Following the suit, SCJ made defamatory statements about DeGuelle in the media. DeGuelle then filed suit in federal court alleging multiple claims, including RICO violations. Id. at 198.

The district court dismissed the RICO claims, holding that the tax fraud and retaliation are unrelated offenses and thus do not form a pattern of racketeering activity. The district court also reasoned that since by the time the retaliation occurred, the government was already aware of alleged tax fraud, the predicate offenses were not the proximate cause of DeGuelle’s injuries. The Seventh Circuit Court of Appeals reversed, holding that “[r]etaliatory acts are inherently connected to the underlying wrongdoing exposed by the whistleblower… Accordingly, we believe a relationship can exist between § 1513(e) predicate acts and predicate acts involving the underlying cause for such retaliation.” Id at 201. The court determined that despite SCJ officials’ attempts to investigate DeGuelle’s concerns and protect him from retaliation, SCJ can still be held liable for retaliatory termination. The court also noted that a whistleblower does not have to show that the same officials participated in both the crime and the retaliation.

Following DeGuelle, in Simkus v. United Airlines, No. 11 C 2165, 2012 WL 3133603, (N.D. Ill. July 31, 2012), Simkus brought a suit against United Airlines under RICO. Simkus alleged two predicate acts in his civil RICO suit that occurred within a ten year period, mail and wire fraud related to United providing Simkus with incorrect information regarding his stock allocation in 2006 and retaliation against Simkus in violation of SOX for reporting asbestos violations to the Occupational Health and Safety Administration (OSHA). The court found that these two acts failed the “continuity plus relationship” test. Unlike the alleged tax fraud and retaliation committed by SCJ, there was no relationship between the two acts alleged by Simkus. Id. at *3-4.

The Seventh Circuit’s holding in DeGuelle illustrates how a whistleblower who has been retaliated against can bring a RICO action against an employer relying upon Section 1107 as a predicate offense.

[1] This case was ultimately dismissed on remand and again on appeal, due to collateral estoppel relating to the judgement in the state court case filed by SCJ, in which DeGuelle represented himself pro se, failing to include affidavits in his response to SCJ’s motion for summary judgment. See DeGuelle v. Camlli 724 F. 3d 9ss (7th Cir. August 1, 2013).

Whistleblower Retaliation Can Give Rise to Breach of Contract Claim

An employer’s breach of an anti-retaliation policy in a Code of Ethics can potentially give rise to a breach of contract claim, although the law varies by state.

For example, in 2015, a federal district court held that an employer’s anti-retaliation policy created legally enforceable rights. See Leyden v. Am. Accreditation Healthcare Comm’n, 83 F. Supp. 3d 241, 247–48 (D.D.C. 2015). In Leyden, the trial court held that the plaintiff had a valid claim based on the employer’s alleged violation of its internal anti-retaliation policy. The court relied on law construing whether employee handbooks created implied contractual rights.

In Leyden, the plaintiff was the Chief Accreditation Officer at the American Accreditation Healthcare Commission, a nonprofit offering accreditation and certification programs to healthcare entities. The defendant had an anti-retaliation policy, which stated: “No URAC employee who in good faith reports any Improper Activities in accordance with this policy shall suffer, and shall be protected from threats of harassment, retaliation, discharge, or other types of discrimination.” The plaintiff voiced concerns that new management was mistreating female executives and that two board members were engaged in conduct that she thought jeopardized the organization’s independence. The defendant then terminated the plaintiff’s employment.

The defendant moved to dismiss the complaint, arguing in relevant part that the anti-retaliation policy did not create contractual rights. Even if it did, the defendant contended, it had disclaimed any such rights in its employee handbook.

However, the court held that the anti-retaliation policy created an implied contract. Id. The court began by reviewing Strass v. Kaiser Foundation Health Plan, a case holding that an employee handbook created an implied contract. Id. at 247 (citing Strass v. Kaiser Found. Health Plan, 744 A.2d 1000 (D.C. 2000)). The court discussed how a manual could create rights, and how an employer could effectively disclaim those rights. Id. The court also rejected the defendant’s argument about the disclaimer, noting that a disclaimer that was “rationally at odds” with the other language in the document may not cut off an implied contract. Id.

In finding an implied contract, the court focused on the employer’s invitation to report “Improper Activities” internally and on the language of the anti-retaliation policy. Id. The court also concluded that the employer’s disclaimer, which was found in a different document, was rationally at odds with the anti-retaliation policy. Id. The reasoning in Leyden may be persuasive in other jurisdictions and provide an important remedy to whistleblowers that are not covered under federal or state whistleblower protection statutes.

SEC Whistleblower Protection Lawyers

The whistleblower attorneys at leading SECnwhistleblower protection law firm Zuckerman Law have extensive experience representing SEC whistleblowers and protecting whistleblowers against retaliation. For a free initial consultation, call us at 202-262-8959 or click here.

Before hiring a whistleblower lawyer, assess the lawyer’s prior experience representing whistleblowers, knowledge of whistleblower laws and prior results. And consider the experience of other whistleblowers working with that attorney. See our client testimonials by clicking here.

SOX Whistleblower Protection for SEC Whistleblowers

How Can our Whistleblower Attorneys Help You Obtain an SEC Whistleblower Award?

SEC Whistleblower Retaliation Lawyers

Tips to Successfully Navigate the SEC Whistleblower Process